Honeywell's Earnings Report Rewards Investors

It is hardly a stretch to say that the bumpy start to 2016 has made a lot of investors nervous, and their moods weren't helped when Boeing's (BA) share price fell to a 52-week low following a discouraging earnings report on Wednesday, Jan. 27.

Warning! GuruFocus has detected 2 Warning Signs with BA. Click here to check it out.

The intrinsic value of BA

But Honeywell's (HON) considerably sunnier report on Friday was more encouraging. Investors were rewarded with the news that Honeywell, a Morris Plains, New Jersey-based conglomerate that makes products and provides services for an extensive and diverse list of customers, saw increases in reported EPS (13%), cash flow from operations (9%) and free cash flow (11%) in 2015 compared to 2014.

What's more, Honeywell's reported EPS went up 28%, its cash flow from operations went up 11%, and its free cash flow went up 17% in the fourth quarter of 2015 compared to the year-ago quarter.

This was achieved in spite of the fact that sales were down 4% in 2015 and 3% in the fourth quarter.

Full-year guidance for 2016 was reaffirmed.

"We grew earnings 10% in a tough environment, representing our sixth consecutive year of double-digit earnings growth," Honeywell chairman and CEO Dave Cote said in the earnings report. "We committed to more than $6 billion in acquisitions in 2015 to bolster our Great Positions in Good Industries, reinvested $1.1 billion in our businesses through high-return capital expenditure projects and returned more than $3.5 billion to our shareowners, including a 15% increase in our dividend."

Only two gurus reported trades involving Honeywell in the fourth quarter - Ken Fisher (Trades, Portfolio), who boosted his stake by a little over 2%, and T Rowe Price Equity Income Fund (Trades, Portfolio), which sold its 1,550,000-share stake. The Fund was only the third guru to sell its Honeywell stake in 2015.

Nineteen gurus were active in Honeywell in the third quarter; given what transpired in the fourth quarter, many may seem positively prescient. Ten added to existing stakes, and two made new buys in the company. The other seven gurus didn't get out of the game entirely. They reduced their stakes.

Honeywell's largest shareholder among the gurus is James Barrow (Trades, Portfolio), whose 12,743,371-share stake is 1.65% of Honeywell's outstanding shares and 1.86% of Barrow's total assets.

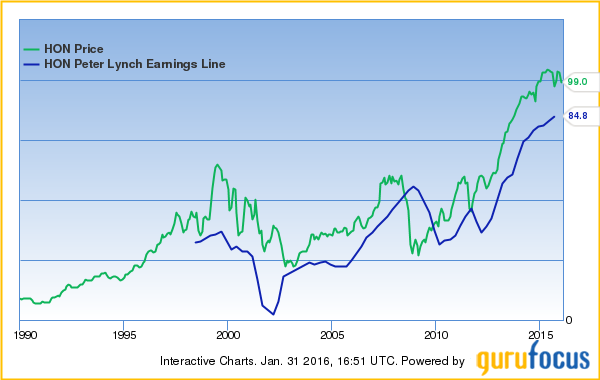

Honeywell has a P/E of 18.2, a forward P/E of 14.4, a P/B of 4.5 and a P/S of 2.1. GuruFocus gives Honeywell a Financial Strength rating of 6/10 and a Profitability and Growth rating of 8/10.

Honeywell's shares sold for $97.97 apiece the day before Friday's earnings report. The price was $103.2 per share Saturday, up more than 5%.

To view gurus' real time picks, visit the Real Time Picks page. Not a premium member of GuruFocus? Try it free for 7 days.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with BA. Click here to check it out.

The intrinsic value of BA