Higher mortgage rates are coming. What could it mean for homebuyers?

The Federal Reserve's announcement this week that it will fight inflation by phasing out a bond-buying program and preparing for faster interest-rate hikes will have far-reaching consequences for home prices and affordability, experts say.

The Fed expects to raise rates three times next year to make borrowing more expensive for individuals and businesses, aiming to cool demand and soaring prices. It also expects more hikes in the following two years, lifting rates from near zero to 2.1% by the end of 2024.

“When the Fed increases its interest rates, banks do, too," says Nadia Evangelou, senior economist, and director of forecasting for the National Association of Realtors. "And when that happens, mortgage rates go up for borrowers."

Evangelou expects mortgage rates to rise to 3.7% by the end of next year.

►No chill this winter:Here's what buyers should expect in the housing market.

►Is a crash coming? Are we due for a housing bust? 8 experts weigh in

Home prices have surged to new heights during the pandemic as remote work fueled record demand for bigger houses and buyers took advantage of historically low mortgage rates to finance their purchases.

What drove down the costs of home loans? During the depths of last year's COVID-19-induced recession, the Fed cut short-term interest rates almost to zero and bought billions of dollars in Treasury- and mortgage-backed securities each month to support the flow of credit. The Fed's intervention pushed mortgages rates to record lows, with the average rate on the benchmark 30-year fixed-rate loan slipping to 2.65% in December 2020.

The central bank’s decision this week to plan for more rate hikes was not a surprise given runaway inflation and a booming job market, says Mike Fratantoni, chief economist at the Mortgage Banker’s Association.

“Going forward, MBA forecasts that mortgage rates will rise to 4% by the end of 2022 and may be more volatile as the Fed backs away from the market,” says Fratantoni. “Although this will lead to a drop in refinances, we expect that the strong economy will support an increase in home sales in 2022.”

What does that mean for home prices in 2022?

If inflation remains high and that translates to higher mortgage rates, it could slow the housing market and put “downward pressure” on home prices, says Leonard Kiefer, an economist for Freddie Mac.

On the other hand, with high inflation, asset prices, including real estate, tend to rise.

►Fighting inflation: Federal Reserve sets stage for earlier, faster interest rate hikes as inflation soars

►'I'm living a nightmare':What homeowners need to know as climate change threatens properties

“So far, it’s been pretty clear that it actually puts upward pressure on house prices," Kiefer says. "So, the two sort of go against each other."

Home price increases will slow down partly as a consequence of interest rate hikes by the Federal Reserve, says Lawrence Yun, chief economist at the NAR.

Yun expects the 30-year fixed mortgage rate to increase to 3.5% by the end of next year as the Fed raises rates. But Yun notes the rate would be still lower than the pre-pandemic rate of 4%.

Home price increases will slow down partly as a consequence of those hikes, he says.

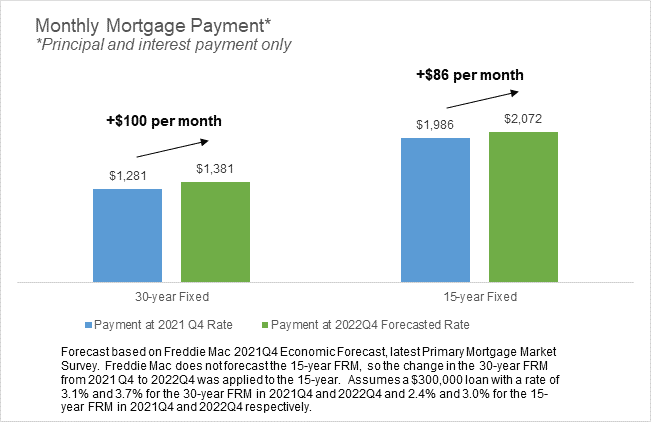

Higher mortgage rates would also erode affordability, with homeowners having to shell out more per month. In its most recent Economic and Housing Market Outlook, Freddie Mac expected the 30-year fixed-rate mortgage to average 3.7% in 2022.

"A homebuyer with a $300,000 mortgage, purchasing that home today at 3.1% for with a 30-year fixed would be paying $1,281 a month," says Kiefer. "By next year, with a 3.7% rate, they would be looking at $1,381 payment per month."

Now is a good time to refinance

Despite low interest rates and the chance to cut their monthly payments by refinancing their loans, among homeowners with a mortgage they’ve had since before the pandemic, 74% have not refinanced, according to an October Bankrate survey.

Swapna Venugopal Ramaswamy is the housing and economy reporter for USA TODAY. Follow her on Twitter @SwapnaVenugopal

This article originally appeared on USA TODAY: Mortgage rates are going up: What homebuyers should know