Here's Why I Think Macfarlane Group (LON:MACF) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Macfarlane Group (LON:MACF), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Macfarlane Group

How Quickly Is Macfarlane Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Macfarlane Group has grown EPS by 7.9% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

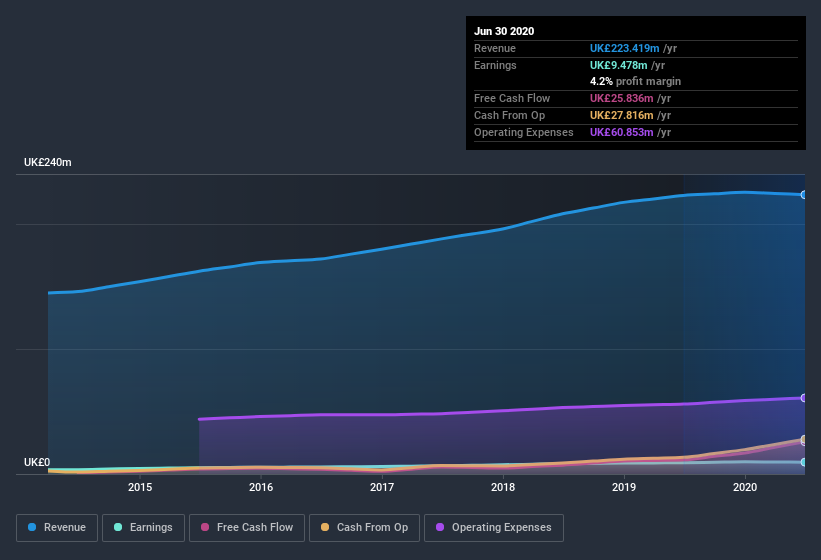

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It seems Macfarlane Group is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Macfarlane Group is no giant, with a market capitalization of UK£138m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Macfarlane Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Macfarlane Group shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Group Finance Director Ivor Gray bought UK£10.0k worth of shares at an average price of around UK£0.85.

Does Macfarlane Group Deserve A Spot On Your Watchlist?

One important encouraging feature of Macfarlane Group is that it is growing profits. While some companies are struggling to grow EPS, Macfarlane Group seems free from that morose affliction. The cherry on top is that we have an insider buying shares. That encourages me further to keep an eye on this stock. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Macfarlane Group is trading on a high P/E or a low P/E, relative to its industry.

As a growth investor I do like to see insider buying. But Macfarlane Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.