Here's Why We Think Bhageria Industries (NSE:BHAGIL) Is Well Worth Watching

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Bhageria Industries (NSE:BHAGIL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Bhageria Industries

How Fast Is Bhageria Industries Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Bhageria Industries has grown EPS by 50% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

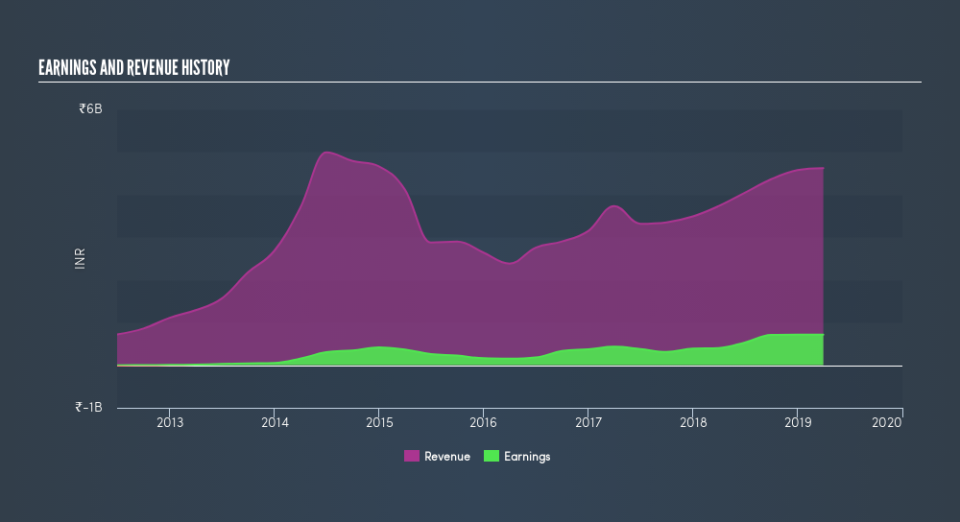

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Bhageria Industries is growing revenues, and EBIT margins improved by 7 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Bhageria Industries is no giant, with a market capitalization of ₹5.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Bhageria Industries Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Bhageria Industries insiders refrain from selling stock during the year, but they also spent ₹4.4m buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. Zooming in, we can see that the biggest insider purchase was by Indu Agarwal for ₹1.5m worth of shares, at about ₹294 per share.

On top of the insider buying, we can also see that Bhageria Industries insiders own a large chunk of the company. Actually, with 45% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about ₹2.4b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Vinodkumar Bhageria is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under ₹14b, like Bhageria Industries, the median CEO pay is around ₹1.3m.

The Bhageria Industries CEO received total compensation of only ₹1.1m in the year to March 2018. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Bhageria Industries To Your Watchlist?

Bhageria Industries's earnings per share growth has been so hot recently that thinking about it is making me blush. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Bhageria Industries may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. Of course, just because Bhageria Industries is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Bhageria Industries is not the only growth stock with insider buying. Here's a a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.