Here's Why HKBN (HKG:1310) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that HKBN Ltd. (HKG:1310) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for HKBN

What Is HKBN's Net Debt?

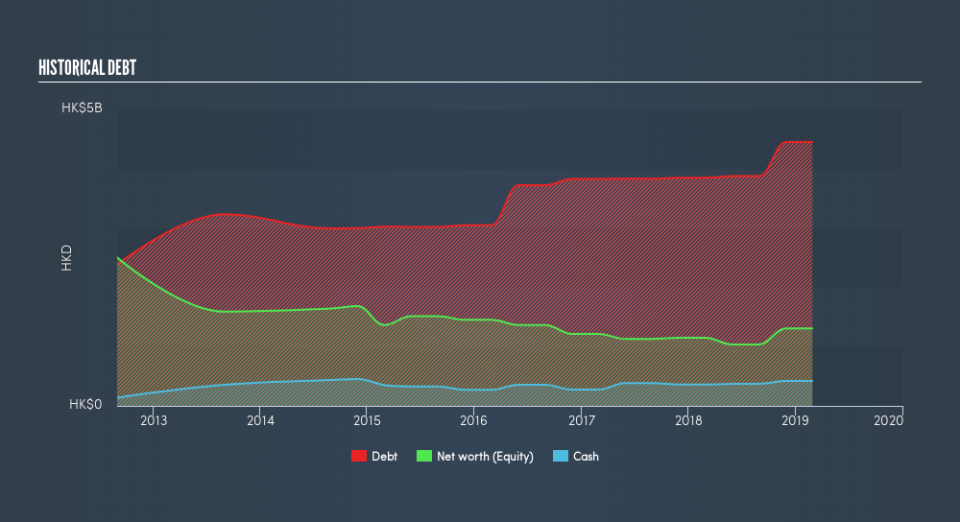

As you can see below, at the end of February 2019, HKBN had HK$4.45b of debt, up from HK$3.85b a year ago. Click the image for more detail. On the flip side, it has HK$420.9m in cash leading to net debt of about HK$4.03b.

A Look At HKBN's Liabilities

According to the last reported balance sheet, HKBN had liabilities of HK$965.5m due within 12 months, and liabilities of HK$5.22b due beyond 12 months. Offsetting this, it had HK$420.9m in cash and HK$609.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$5.15b.

HKBN has a market capitalization of HK$18.5b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

HKBN's debt is 3.3 times its EBITDA, and its EBIT cover its interest expense 5.0 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. HKBN grew its EBIT by 6.1% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine HKBN's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, HKBN actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that HKBN's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that HKBN can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. We'd be motivated to research the stock further if we found out that HKBN insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.