Here's Why Feiyang International Holdings Group (HKG:1901) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Feiyang International Holdings Group Limited (HKG:1901) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Feiyang International Holdings Group

How Much Debt Does Feiyang International Holdings Group Carry?

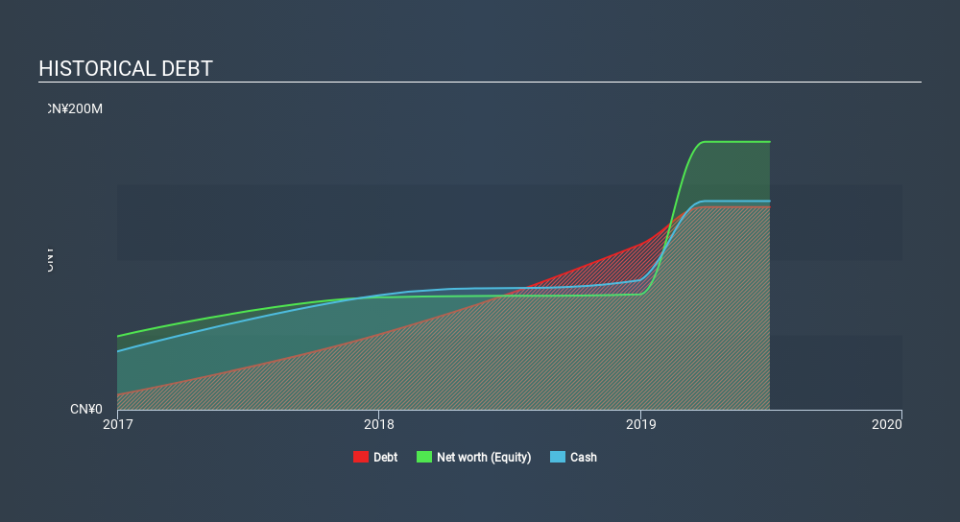

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Feiyang International Holdings Group had CN¥135.0m of debt, an increase on CN¥50.0, over one year. However, its balance sheet shows it holds CN¥138.9m in cash, so it actually has CN¥3.95m net cash.

A Look At Feiyang International Holdings Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Feiyang International Holdings Group had liabilities of CN¥287.7m due within 12 months and liabilities of CN¥24.4m due beyond that. On the other hand, it had cash of CN¥138.9m and CN¥147.2m worth of receivables due within a year. So it has liabilities totalling CN¥25.9m more than its cash and near-term receivables, combined.

Since publicly traded Feiyang International Holdings Group shares are worth a total of CN¥490.0m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Feiyang International Holdings Group also has more cash than debt, so we're pretty confident it can manage its debt safely.

Shareholders should be aware that Feiyang International Holdings Group's EBIT was down 37% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Feiyang International Holdings Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Feiyang International Holdings Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Feiyang International Holdings Group saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Feiyang International Holdings Group has CN¥3.95m in net cash. Despite its cash we think that Feiyang International Holdings Group seems to struggle to grow its EBIT, so we are wary of the stock. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Feiyang International Holdings Group's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.