If You Had Bought Republic Healthcare (HKG:8357) Shares A Year Ago You'd Have Made 16%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Republic Healthcare Limited (HKG:8357) share price is up 16% in the last year, clearly besting than the market return of around -13% (not including dividends). So that should have shareholders smiling. Republic Healthcare hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Republic Healthcare

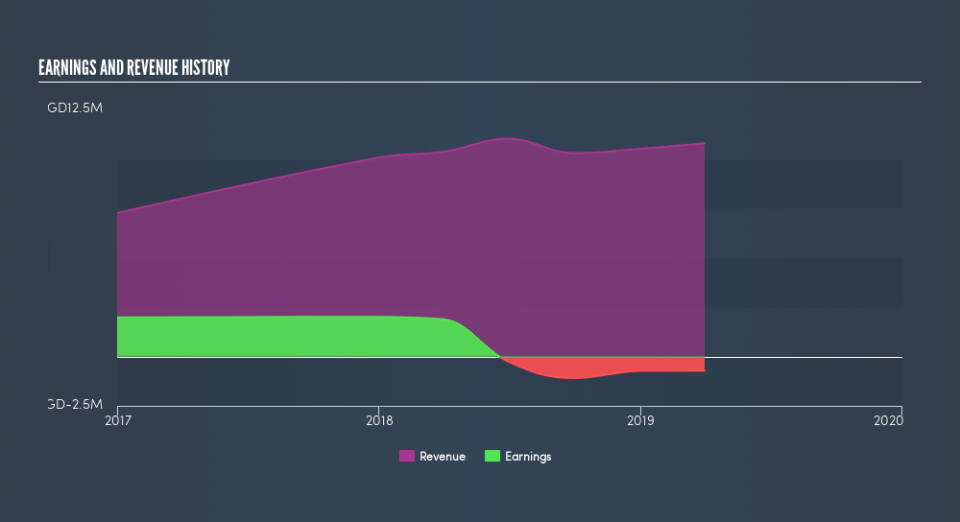

Because Republic Healthcare is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Republic Healthcare's revenue grew by 4.2%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 16%. While not a huge gain tht seems pretty reasonable. It could be worth keeping an eye on this one, especially if growth accelerates.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Republic Healthcare boasts a total shareholder return of 16% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 5.7% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Republic Healthcare may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.