If You Had Bought CGN Mining (HKG:1164) Stock Five Years Ago, You'd Be Sitting On A 64% Loss, Today

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the CGN Mining Company Limited (HKG:1164) share price is a whole 64% lower. That's not a lot of fun for true believers.

See our latest analysis for CGN Mining

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, CGN Mining moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

We don't think that the 1.6% is big factor in the share price, since it's quite small, as dividends go. It could be that the revenue decline of 16% per year is viewed as evidence that CGN Mining is shrinking. This has probably encouraged some shareholders to sell down the stock.

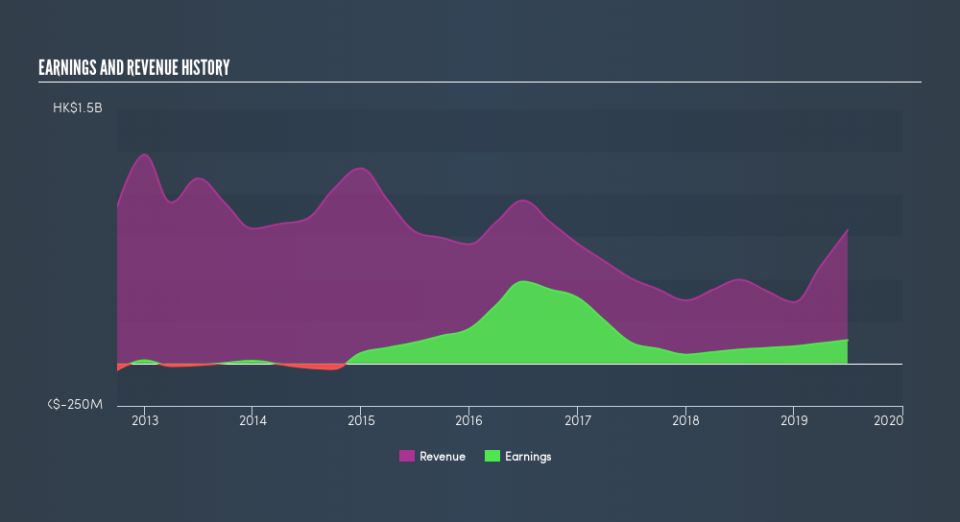

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We've already covered CGN Mining's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that CGN Mining's TSR, which was a 62% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We regret to report that CGN Mining shareholders are down 16% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 10%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 18% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before forming an opinion on CGN Mining you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.