If You Had Bought A2Z Smart Technologies (CVE:AZ) Stock A Year Ago, You Could Pocket A 49% Gain Today

Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the A2Z Smart Technologies Corp. (CVE:AZ) share price is 49% higher than it was a year ago, much better than the market return of around 0.3% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow A2Z Smart Technologies for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for A2Z Smart Technologies

A2Z Smart Technologies recorded just US$1,085,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that A2Z Smart Technologies can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

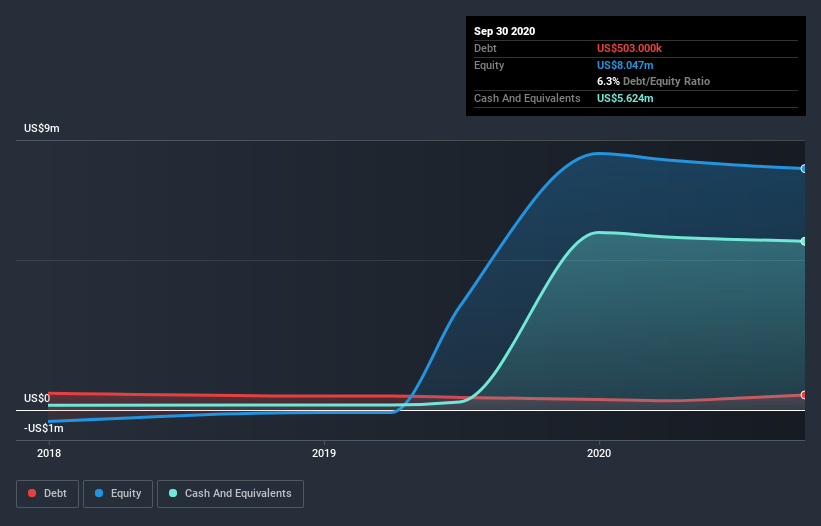

A2Z Smart Technologies had cash in excess of all liabilities of when it last reported. That's not too bad but management decided to raise capital in any case to shore up the balance sheet since the company is not yet breaking even. Given the share price has increased by a solid 126% in the last year , it's fair to say investors remain excited about the future with some additional cash available. The image below shows how A2Z Smart Technologies' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

A Different Perspective

A2Z Smart Technologies shareholders should be happy with the total gain of 49% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 83% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand A2Z Smart Technologies better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for A2Z Smart Technologies you should be aware of, and 1 of them is a bit unpleasant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.