Forget Apple: This Other Buyback Stock Soared 28% Over the Last Year, and Could Be Headed Even Higher

Earlier this month, iPhone maker Apple turned heads after announcing a $110 billion stock buyback. On the surface, this looks like great news for investors. However, I see the latest buyback as a way to distract investors from the operational challenges Apple faces. Investors may be finally getting fed up, as shares of Apple are modestly down over the last year.

Another company that has a history of aggressive stock buybacks is AutoNation (NYSE: AN). Over the last year, shares of AutoNation have jumped 28% -- and I think they are headed even higher. Let's break down the full picture at AutoNation, and explore why scooping up some shares could be a lucrative choice for long-term investors.

A close look at AutoNation's stock buybacks

The chart below illustrates AutoNation's stock buyback history over the last 10 years. Although the company has consistently repurchased shares, notable buybacks occurred between 2021 and 2022 -- during which the company bought back a staggering $4 billion worth of stock.

During the company's most recent earnings call, investors learned that the Board of Directors authorized an additional $1 billion of share repurchases.

There are a couple of reasons companies might decide to buy back shares. For instance, management may view the stock as undervalued and decide to repurchase shares at an attractive valuation.

Another reason buybacks can occur is that they essentially act as a form of financial engineering. When a company repurchases stock, its outstanding shares decrease.

As a result, lowering the number of shares can help juice earnings per share (EPS). This dynamic comes in handy when a company is experiencing decelerating growth, as it can give the impression that earnings are expanding despite a drop in revenue.

A tough economy is weighing on the car industry

For the last couple of years, the macroeconomy has been challenged by unusually high inflation and rising borrowing costs. Indeed, inflation has cooled to 3.4% -- far lower than peak levels of 9% during 2022.

However, interest rates remain elevated, and it is not entirely clear when or if the Federal Reserve will begin tapering. During AutoNation's earnings call, management cited high interest rates as one factor in a challenging selling environment, as purchasing power simply is not strong right now.

For the three months ended March 31, AutoNation's revenue increased by a meager 1% year over year to $6.5 billion, but gross profit declined by 7%. Unsurprisingly, the margin deterioration dropped to the bottom line, as net income and EPS dropped by 34% and 26%, respectively, during the first quarter.

There is an important nuance to analyze from the financials above. You might notice that net income and EPS dropped by vastly different rates. This is because the company purchased $39 million of stock during the first quarter -- thereby reducing the number of outstanding shares.

Management even called this out during the earnings call, stating that "our share repurchase activity helped to partially offset the EPS effects of the net income decline."

Is AutoNation a good stock to buy right now?

Selling cars is not exactly the most innovative and growth-oriented business. Considering the number of options that people have, car sales is a relatively commoditized industry, and businesses often need to compete on price. AutoNation is no exception.

As of the end of Q1, inventory levels across both used and new vehicles rose year over year. While it's clear that the current state of the economy is causing some turbulence for AutoNation, one silver lining from the earnings report was that same-store sales among vehicles priced under $20,000 actually increased by 5% year over year.

I think this sheds light on a couple of important themes. First, people are opting for lower-priced vehicles right now. Second, while inventory remains elevated, people are still buying cars -- they are just doing so at a protracted pace.

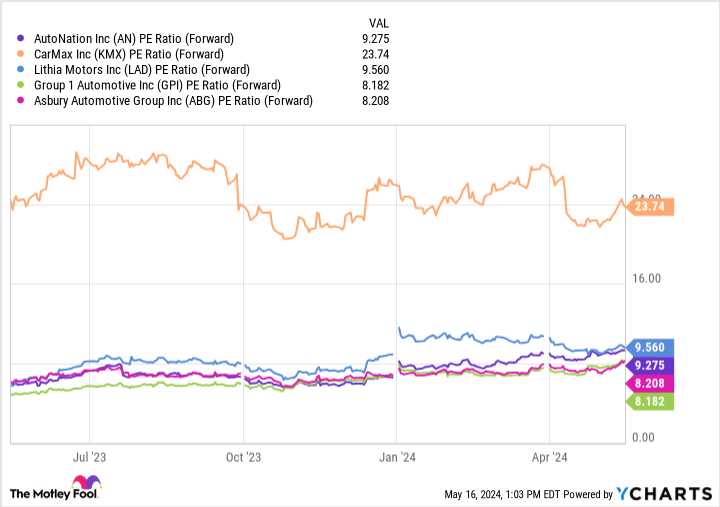

Investors can see from the chart above that AutoNation is actually valued in line with many of its peers on a forward price-to-earnings (P/E) basis, with the lone exception being CarMax.

I see AutoNation as a bit of a turnaround opportunity. It's important to remember that the economy will strengthen in the long run, as inflation and interest rates do not rise in perpetuity.

Considering AutoNation is making investments in marketing as well as capital expenditures (capex) to build its inventory, I am cautiously optimistic that the company has an encouraging long-term picture.

Investors may want to consider scooping up shares in AutoNation as the company continues chugging along in a tough economic environment, and as management continues buying up stock.

Should you invest $1,000 in AutoNation right now?

Before you buy stock in AutoNation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AutoNation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Adam Spatacco has positions in Apple. The Motley Fool has positions in and recommends Apple and CarMax. The Motley Fool has a disclosure policy.

Forget Apple: This Other Buyback Stock Soared 28% Over the Last Year, and Could Be Headed Even Higher was originally published by The Motley Fool