Fed’s $7.3 trillion balance sheet is worrying the world’s largest asset manager. Here’s why.

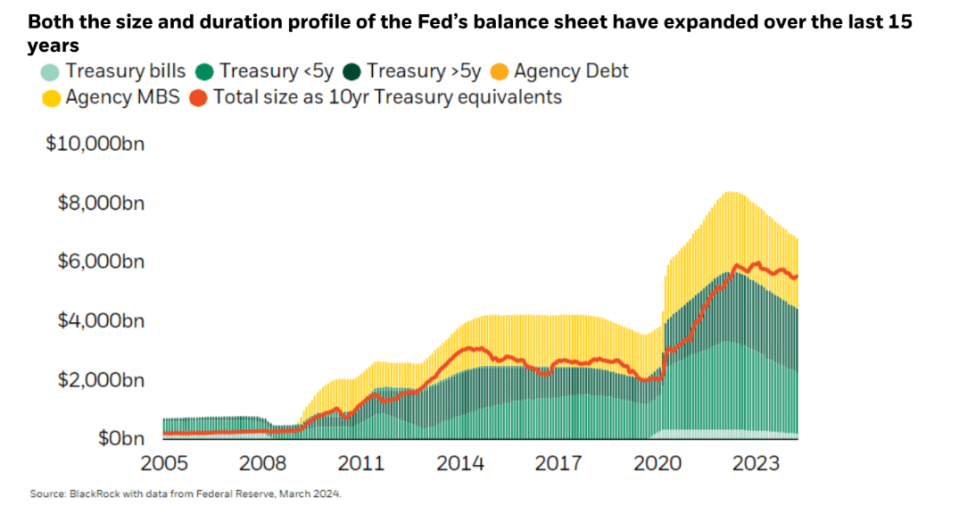

Changes to how the Federal Reserve manages one of world’s most crucial piles of assets pose “underappreciated” risks to financial markets, BlackRock warned in a Friday client note.

The Fed in early May said it plans to switch up how quickly it will look to shrink its $7.3 trillion balance sheet beginning June 1, a move that was “barely a side note” in financial markets, according to Tom Becker, portfolio manager at BlackRock’s Global Tactical Asset Allocation team.

Most Read from MarketWatch

Nvidia earnings are on deck, and Wall Street wonders just how big the beat could be

Homes are overvalued in much of the U.S. — with these 5 states leading the list

Technology stocks are once again leading the way in 2024. Why these ETFs tell a different story.

But it was not a minor development in the eyes of BlackRock BLK, which held a record $10.5 trillion in assets in the first quarter, further entrenching it as the world’s largest asset manager.

The Fed said its “quantitative-tightening” program will soon allow only up to $25 billion of maturing Treasury securities to roll off its balance sheet each month, instead of the previous $60 billion cap.

Any proceeds from maturing mortgage-backed securities (MBS) above the $35 billion monthly cap for those assets also would be reinvested into Treasurys.

Yet it’s the makeup of the Fed’s balance sheet and not the “size that matters,” according to Becker. “The composition of the balance sheet today is likely suppressing 10-year [Treasury] BX:TMUBMUSD10Y yields by over 2% and potentially by as much as 4%,” he wrote. The benchmark 10-year rate was near 4.42% on Friday, down from a recent high of 4.7%.

If the “economy continues to expand strong and inflation remains sticky, we see a growing chance that future tightening discussions could involve altering the composition of balance-sheet holdings,” Becker added.

Read: Fed’s Barkin says consumers are driving inflation. Here’s what they’re willing to pay more for.

Importantly, his team views an “active” shrinking approach or “recasting” of the Fed’s balance sheet as “an underappreciated risk,” particularly after November’s U.S. election.

Becker pointed to a recent speech by Fed Governor Chris Waller that outlined his preference for shifting toward shorter-dated securities holdings and no MBS exposure.

“Transitioning to a shorter-duration balance sheet would likely drive up long-dated government-bond yields and be negative” for the U.S. dollar DXY, Becker wrote, noting that BlackRock’s Tactical Opportunities Fund PBAIX has those two sets of exposures.

To that end, the fund increased its short position on the U.S. dollar this year, but was long U.S. stocks and short long-duration government bonds, as of April 30.

“There are voices on the committee now advocating for a substantial reassessment of the balance sheet,” Becker said.

The Dow Jones Industrial Average DJIA closed above the 40,000-point mark for the first time ever Friday, sealing a 1.2% weekly advance, according to FactSet data. The S&P 500 SPX booked a 1.5% weekly rise, while the Nasdaq Composite COMP gained 2.1% on the week.