February Top Dividend Payers

Frasers Centrepoint Trust, CapitaLand Mall Trust, and DBS Group Holdings all share one thing in common. They are on our list of top paying dividend stocks which have helped grow my portfolio income over the past couple of months. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

Frasers Centrepoint Trust (SGX:J69U)

Frasers Centrepoint Trust (“FCT”) is a leading developer-sponsored retail real estate investment trust. The company was established in 2006 and with the company’s market cap sitting at SGD SGD2.01B, it falls under the mid-cap group.

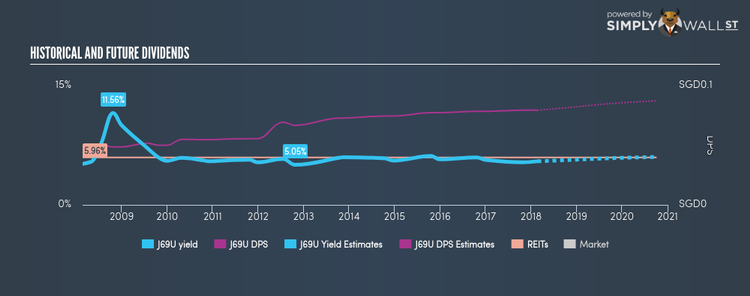

J69U has a great dividend yield of 5.48% and their current payout ratio is 56.87% , with the expected payout in three years being 91.06%. J69U’s dividends have increased in the last 10 years, with DPS increasing from S$0.064 to S$0.12. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Frasers Centrepoint Trust’s earnings per share growth of 59.56% outpaced the sg reits industry’s 7.61% average growth rate over the last year. Continue research on Frasers Centrepoint Trust here.

CapitaLand Mall Trust (SGX:C38U)

CMT is the first real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) in July 2002. The company was established in 2001 and with the stock’s market cap sitting at SGD SGD7.06B, it comes under the mid-cap group.

C38U has a enticing dividend yield of 5.61% and their payout ratio stands at 60.16% , and analysts are expecting a 88.00% payout ratio in the next three years. Although C38U have been a reliable payer, there has been no increase in the past 10 years. The company recorded earnings growth of 40.10% in the past year, comparing favorably with the sg reits industry average of 7.61%. Dig deeper into CapitaLand Mall Trust here.

DBS Group Holdings Ltd (SGX:D05)

DBS Group Holdings Ltd provides various commercial banking and financial services in Singapore, Hong Kong, rest of Greater China, South and Southeast Asia, and internationally. Established in 1968, and now run by Piyush Gupta, the company provides employment to 24,174 people and with the company’s market capitalisation at SGD SGD75.51B, we can put it in the large-cap stocks category.

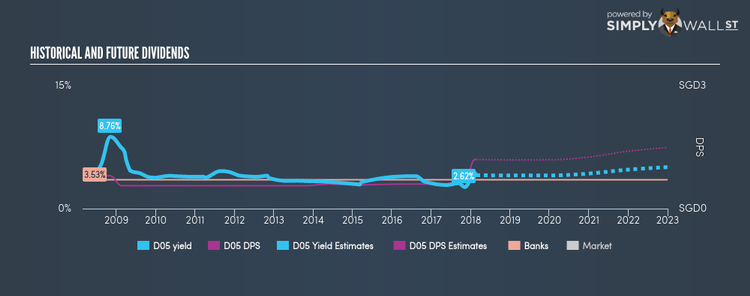

D05 has a great dividend yield of 4.08% and pays out 54.25% of its profit as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. The company’s future earnings growth looks promising, with analysts expecting earnings growth over the next three years to reach 58.97%. Continue research on DBS Group Holdings here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.