Examining Kothari Products Limited’s (NSE:KOTHARIPRO) Weak Return On Capital Employed

Today we are going to look at Kothari Products Limited (NSE:KOTHARIPRO) to see whether it might be an attractive investment prospect. In particular, we’ll consider its Return On Capital Employed (ROCE), as that can give us insight into how profitably the company is able to employ capital in its business.

Firstly, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. Finally, we’ll look at how its current liabilities affect its ROCE.

Return On Capital Employed (ROCE): What is it?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. All else being equal, a better business will have a higher ROCE. Overall, it is a valuable metric that has its flaws. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Kothari Products:

0.14 = ₹1.6b ÷ (₹36b – ₹24b) (Based on the trailing twelve months to March 2018.)

Therefore, Kothari Products has an ROCE of 14%.

View our latest analysis for Kothari Products

Want to help shape the future of investing tools and platforms? Take the survey and be part of one of the most advanced studies of stock market investors to date.

Is Kothari Products’s ROCE Good?

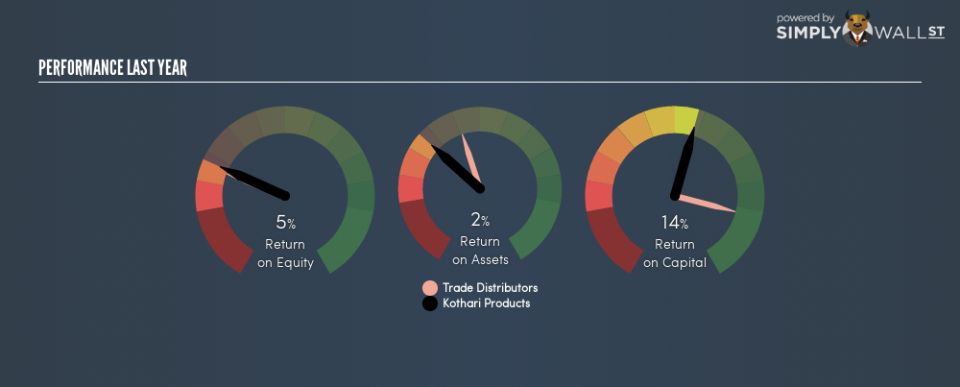

ROCE is commonly used for comparing the performance of similar businesses. Kothari Products’s ROCE appears to be substantially greater than the 6.2% average in the Trade Distributors industry. We consider this a positive sign, because it suggests it uses capital more efficiently than similar companies. Separate from how Kothari Products stacks up against its industry, its ROCE in absolute terms is mediocre; relative to the returns on government bonds. Readers may find more attractive investment prospects elsewhere.

As we can see, Kothari Products currently has an ROCE of 14%, less than the 25% it reported 3 years ago. This makes us wonder if the business is facing new challenges.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. If Kothari Products is cyclical, it could make sense to check out this free graph of past earnings, revenue and cash flow.

What Are Current Liabilities, And How Do They Affect Kothari Products’s ROCE?

Short term (or current) liabilities, are things like supplier invoices, overdrafts, or tax bills that need to be paid within 12 months. Due to the way the ROCE equation works, having large bills due in the near term can make it look as though a company has less capital employed, and thus a higher ROCE than usual. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Kothari Products has total liabilities of ₹24b and total assets of ₹36b. Therefore its current liabilities are equivalent to approximately 68% of its total assets. With a high level of current liabilities, Kothari Products will experience a boost to its ROCE.

What We Can Learn From Kothari Products’s ROCE

Despite this, the company also has a uninspiring ROCE, which is not an ideal combination in this analysis. Of course you might be able to find a better stock than Kothari Products. So you may wish to see this free collection of other companies that have grown earnings strongly.

I will like Kothari Products better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.