EUR/USD Technical Analysis: Waiting to Re-Enter Short Trade

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

EUR/USD Technical Strategy: Flat

Euro Trying to Correct Higher After Finding Interim Support Below 1.09 Figure

Down Trend Remains Intact, Waiting for Confirmation to Re-Enter Short Position

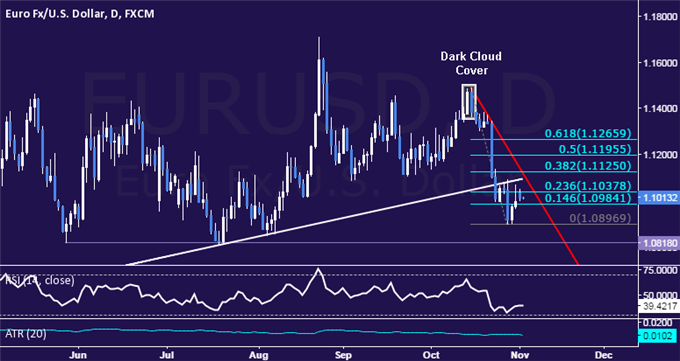

The Euro is attempting to mount a cautious recovery after prices found support just below the 1.09 figure against the US Dollar. As it stands however, the down trend triggered following expected topping marked by the appearance of a bearish Dark Cloud Cover candlestick pattern remains intact.

From here, a daily close below support at 1.0984 – the 14.6% Fibonacci retracement – opens the door for another test of the October 28 low at 1.0897. Alternatively, a move through resistance at 1.1038, the 23.6% Fib, sees the next upside barrier marked by the intersection of a falling trend line and the 38.2% level at 1.1125.

We sold EUR/USD at 1.1057 and subsequently booked profit on half of the trade. The rest of the position was stopped out at the breakeven level as prices corrected upward. We will remain on the sidelines for now, waiting for the currency to offer another opportunity to enter short in line with the long-term down trend.

Losing Money Trading Forex? This Might Be Why.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.