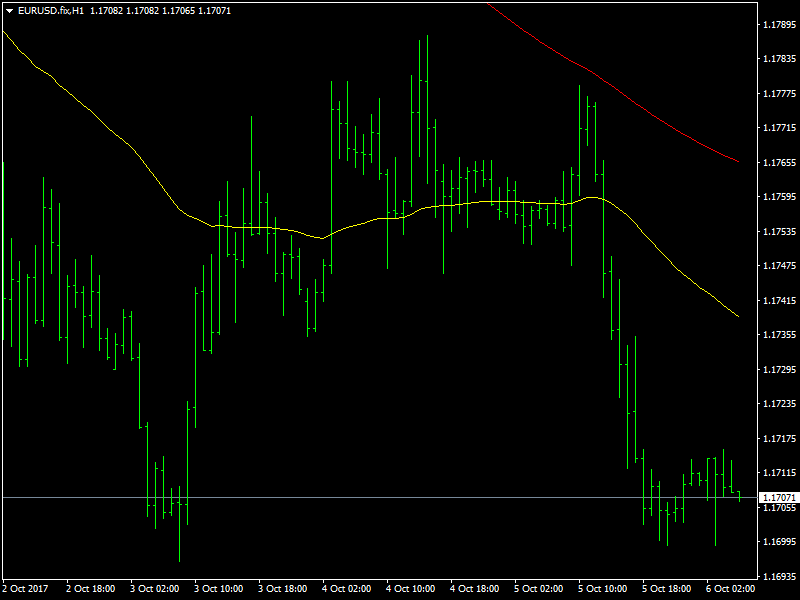

EUR/USD Daily Fundamental Forecast – October 6, 2017

We finally got to see some volatility in the EURUSD pair as the dollar bulls decided to make their move a bit early before the important employment report which is scheduled to be released today. It remains to be seen whether the report would continue to favor the dollar bulls and thus help to continue the momentum in the dollar or whether it would mark the end of the dollar rebound.

Dollar Rebounds Further

The day began slow for the pair and it was only towards the US session that the dollar strength began to pick up all across the board. It helped to bring to life a dull market as the pair slipped just below the 1.17 region for a brief while before managing to cross back higher but it continues to trade in a weak manner as of this writing as the market awaits the data from the US.

The slip in the pair was mainly due to the strength of the dollar where the factory orders data came in much stronger than expected. This gave a bit of a boost and there was also talk that due to the strong factory orders,there is a possibility that the the wages data, which is released along with the NFP, could also come in stronger than expected and this helped to boost the dollar even more as the day dragged on. We have now crossed some important supports in this pair which exposes the euro to further weakening.

Looking ahead to the rest of the day, the focus would obviously be on the NFP data and the wages data as these are the data points that the market has been waiting for, all week. A strong piece of data would help the dollar to recover further and this would mark the complete turnaround of the trend for the dollar. A weaker report would help the euro to bounce from here but we believe that such a bounce is likely to be short lived.

This article was originally posted on FX Empire