EUR/USD Daily Fundamental Forecast – July 4, 2017

The move in the EURUSD pair was along expected lines as the pair corrected during the course of the day yesterday as we saw the dollar stage a recovery all across the board yesterday. We had mentioned the same in our forecast yesterday that with the pair having reached the strong resistance region at around 1.0440 during the course of last week, the traders would need some rest and this could lead to a correction in the pair and this happened yesterday.

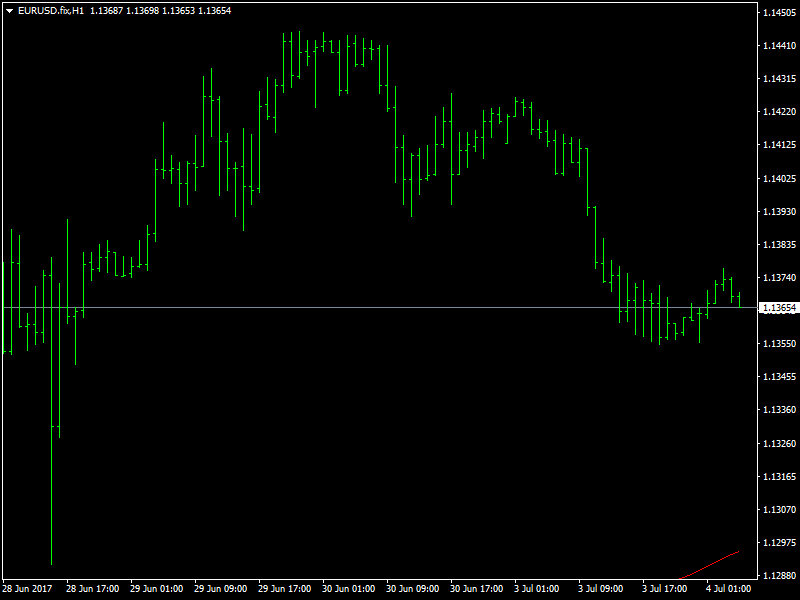

EURUSD Corrects Its Uptrend

The pair had been tearing higher over the course of last week on the back of hawkish comments from Draghi and also due to the weakness in the dollar that was brought about by the failure of the Trump team to push through the healthcare reform bill due to the opposition from within their own ranks. This had placed the dollar on the backfoot and this helped the other currencies to make some huge gains against the dollar and the euro was one of them. The euro pushed through 1.0300 and went as far high as 1.0440 and considering the quick and large rise that we had seen last week, it was only natural to expect some correction to take place.

This correction in the prices took place yesterday as the pair moved through 1.0400 when the London session opened and continued to move lower and trade weakly during the course of the day as the dollar continued to gain in strength. The ISM Manufacturing data also came in at a better than expected value of 57.8 and this has raised the anticipation for some strong employment data from the US in the second half of the week. We believe that the pair would continue to consolidate and remain range bound till the release of this data.

Looking ahead to the rest of the day, it is a holiday in the US and so there is more reason for us to expect some slow and ranging trading for the rest of the day with the absence of liquidity and volatility.

This article was originally posted on FX Empire