Easy Come, Easy Go: How APT Satellite Holdings (HKG:1045) Shareholders Got Unlucky And Saw 76% Of Their Cash Evaporate

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Anyone who held APT Satellite Holdings Limited (HKG:1045) for five years would be nursing their metaphorical wounds since the share price dropped 76% in that time. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days.

View our latest analysis for APT Satellite Holdings

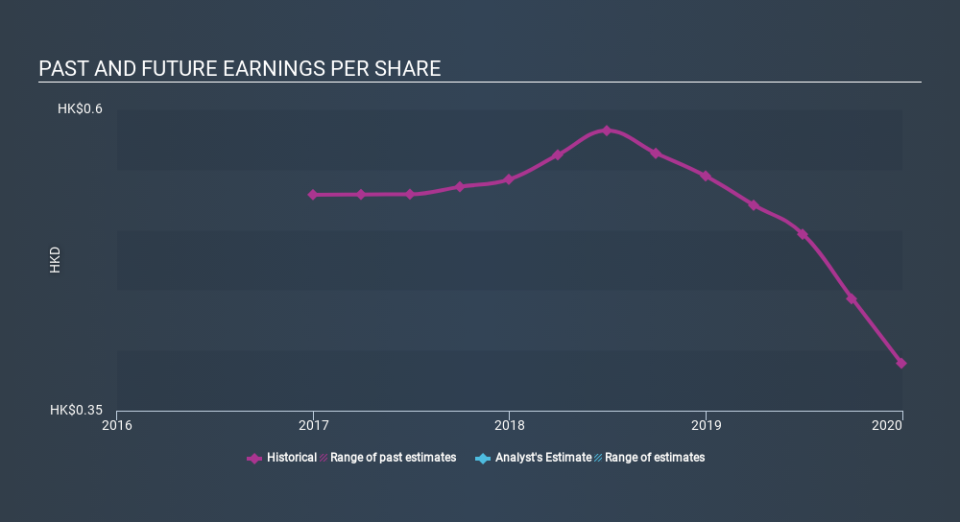

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both APT Satellite Holdings's share price and EPS declined; the latter at a rate of 6.5% per year. This reduction in EPS is less than the 25% annual reduction in the share price. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 5.83 further reflects this reticence.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into APT Satellite Holdings's key metrics by checking this interactive graph of APT Satellite Holdings's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of APT Satellite Holdings, it has a TSR of -72% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 3.8% in the twelve months, APT Satellite Holdings shareholders did even worse, losing 14% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 22% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that APT Satellite Holdings is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

We will like APT Satellite Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.