How Does China State Construction Development Holdings Limited (HKG:830) Stand Up To These Simple Dividend Safety Checks?

Dividend paying stocks like China State Construction Development Holdings Limited (HKG:830) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

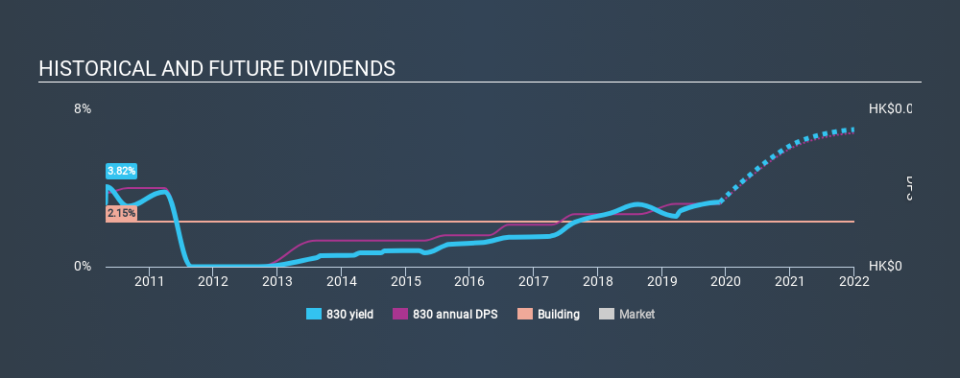

In this case, China State Construction Development Holdings likely looks attractive to investors, given its 3.1% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, China State Construction Development Holdings paid out 31% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. China State Construction Development Holdings's cash payout ratio in the last year was 29%, which suggests dividends were well covered by cash generated by the business. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Consider getting our latest analysis on China State Construction Development Holdings's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of China State Construction Development Holdings's dividend payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was HK$0.028 in 2009, compared to HK$0.024 last year. The dividend has shrunk at around 1.6% a year during that period. China State Construction Development Holdings's dividend has been cut sharply at least once, so it hasn't fallen by 1.6% every year, but this is a decent approximation of the long term change.

We struggle to make a case for buying China State Construction Development Holdings for its dividend, given that payments have shrunk over the past ten years.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see China State Construction Development Holdings has been growing its earnings per share at 27% a year over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's great to see that China State Construction Development Holdings is paying out a low percentage of its earnings and cash flow. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Overall we think China State Construction Development Holdings scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Are management backing themselves to deliver performance? Check their shareholdings in China State Construction Development Holdings in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.