Does BIO-UV Group's (EPA:ALTUV) Share Price Gain of 16% Match Its Business Performance?

We believe investing is smart because history shows that stock markets go higher in the long term. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the BIO-UV Group S.A. (EPA:ALTUV) share price is up 16% in the last year, that falls short of the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for BIO-UV Group

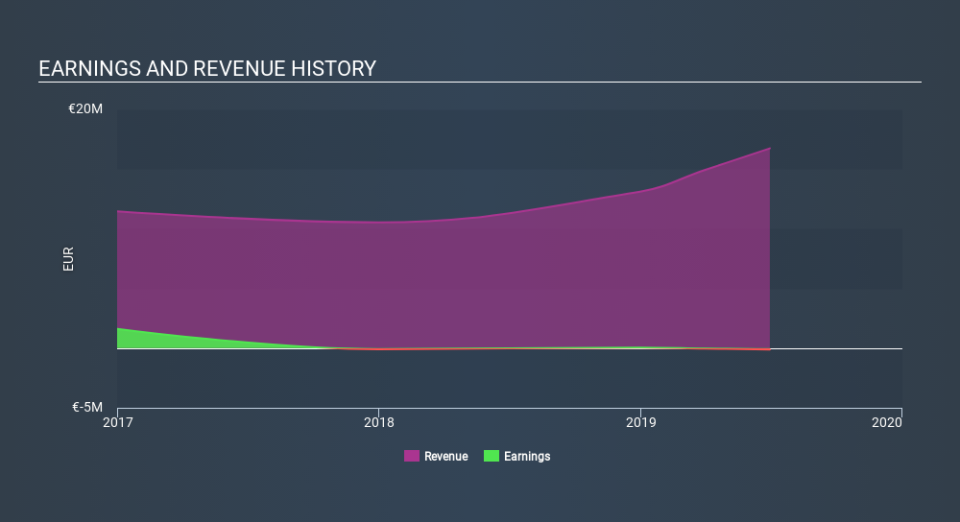

Given that BIO-UV Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

BIO-UV Group grew its revenue by 42% last year. That's a fairly respectable growth rate. The share price gain of 16% seems pretty muted, considering the growth. Arguably, the market (previously) expected stronger growth from the company. But this one could be a worth watching - a maiden profit would likely catch the market's attention.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

BIO-UV Group shareholders have gained 16% for the year. The bad news is that's no better than the average market return, which was roughly 31%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 6.2% in the last three months. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.