Disney Q4 Preview: Another EPS Beat Inbound?

The Zacks Consumer Discretionary Sector has sailed through rough waters in 2022, down more than 35% and coming nowhere near the general market’s performance.

A titan in the realm, The Walt Disney Company DIS, is on deck to unveil Q4 results on November 8th, after the market close.

Disney has assets spanning movies, television shows, and theme parks. In addition, the company’s premium streaming service, Disney +, has been a significant hit among consumers.

Currently, the entertainment giant carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a D.

How does everything else stack up heading into the print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, Disney shares have experienced adverse price action, down roughly 35% and widely underperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, however, the selling has visibly slowed, with DIS shares losing 8% in value and outperforming the S&P 500 modestly.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio currently sits at 1.9X, well below its 3.1X five-year median but above the Zacks Consumer Discretionary sector average of 1.5X.

Further, DIS carries a Style Score of a C for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish regarding their earnings outlook over the last several months, with five negative earnings estimate revisions hitting the tape.

Still, the Zacks Consensus EPS Estimate of $0.50 suggests a Y/Y earnings uptick of more than 35%.

Image Source: Zacks Investment Research

The company’s top-line appears to be in solid shape also; the Zacks Consensus Sales Estimate of $21.1 billion indicates an improvement of more than 13% Y/Y.

Quarterly Performance

DIS has primarily posted mixed earnings results as of late, exceeding earnings and revenue estimates in two of its last four quarters. Still, in its latest print, the company registered a 16% bottom-line beat paired with a 1.8% sales surprise.

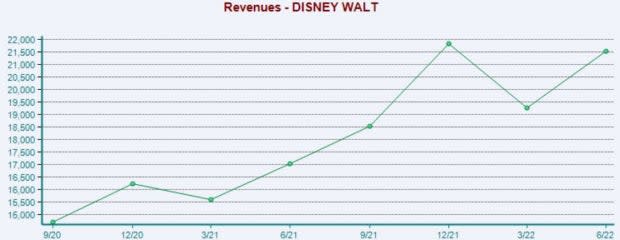

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

DIS shares are in the red YTD but have marginally outperformed the S&P 500 over the last three months, indicating that the selling has slowed by a notable margin.

Shares trade below their five-year median forward price-to-sales ratio but above their Zacks sector average.

Analysts have been bearish for the quarter to be reported, with estimates suggesting Y/Y upticks in both revenue and earnings.

The company has posted mixed earnings results across its last four releases but exceeded both revenue and EPS estimates in its most recent print.

Heading into the release, The Walt Disney Company DIS carries a Zacks Rank #3 (Hold) paired with an Earnings ESP Score of -8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research