Do Directors Own Sandmartin International Holdings Limited (HKG:482) Shares?

Every investor in Sandmartin International Holdings Limited (HKG:482) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, ‘Don’t tell me what you think, tell me what you have in your portfolio.’

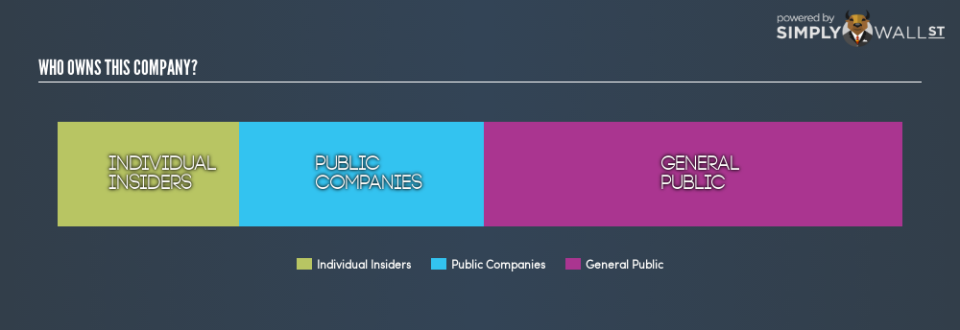

Sandmartin International Holdings is a smaller company with a market capitalization of HK$226m, so it may still be flying under the radar of many institutional investors. Taking a look at the our data on the ownership groups (below), it’s seems that institutions don’t own shares in the company. Let’s take a closer look to see what the different types of shareholder can tell us about 482.

View our latest analysis for Sandmartin International Holdings

What Does The Lack Of Institutional Ownership Tell Us About Sandmartin International Holdings?

Small companies that are not very actively traded often lack institutional investors, but it’s less common to see large companies without them.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don’t attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. On the other hand, it’s always possible that professional investors are avoiding a company because they don’t think it’s the best place for their money. Sandmartin International Holdings might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don’t have many shares in Sandmartin International Holdings. Our information suggests that there isn’t any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Sandmartin International Holdings

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of Sandmartin International Holdings Limited. Insiders own HK$49m worth of shares in the HK$226m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, with a 49% stake in the company, will not easily be ignored. While this group can’t necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

We can see that public companies hold 29%, of the 482 shares on issue. It’s hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it’s worth watching this space for changes in ownership.

Next Steps:

It’s always worth thinking about the different groups who own shares in a company. But to understand Sandmartin International Holdings better, we need to consider many other factors.

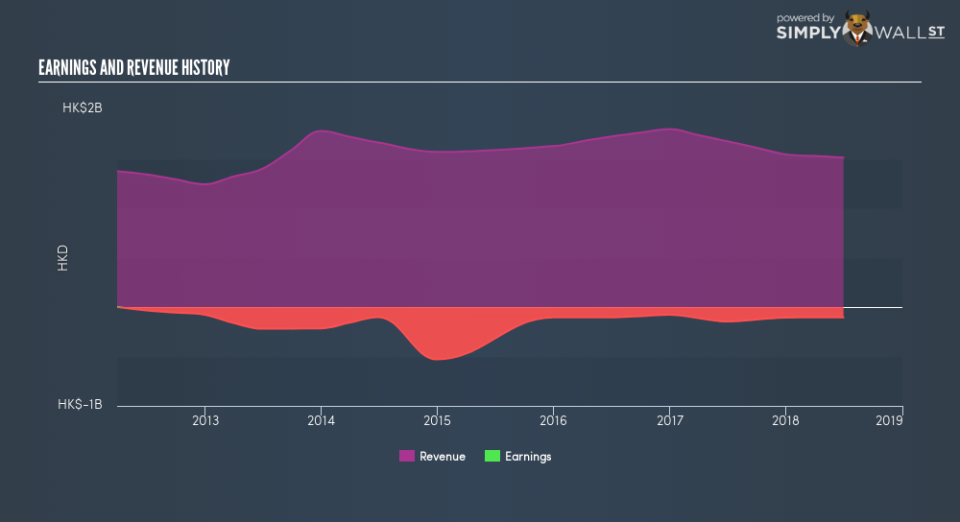

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.