Could Lincoln Minerals Limited’s (ASX:LML) Investor Composition Influence The Stock Price?

Every investor in Lincoln Minerals Limited (ASX:LML) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes ‘a business with enduring competitive advantages that is run by able and owner-oriented people’. So it’s nice to see some insider ownership, because it may suggest that management is owner-oriented.

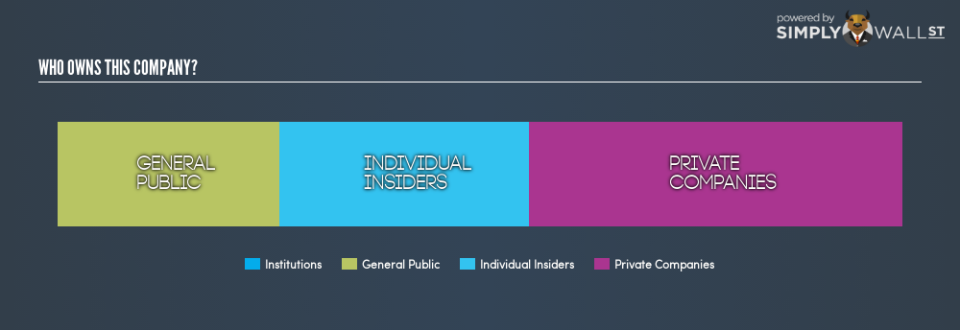

With a market capitalization of AU$4.0m, Lincoln Minerals is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don’t own shares in the company. We can zoom in on the different ownership groups, to learn more about LML.

See our latest analysis for Lincoln Minerals

What Does The Lack Of Institutional Ownership Tell Us About Lincoln Minerals?

Small companies that are not very actively traded often lack institutional investors, but it’s less common to see large companies without them.

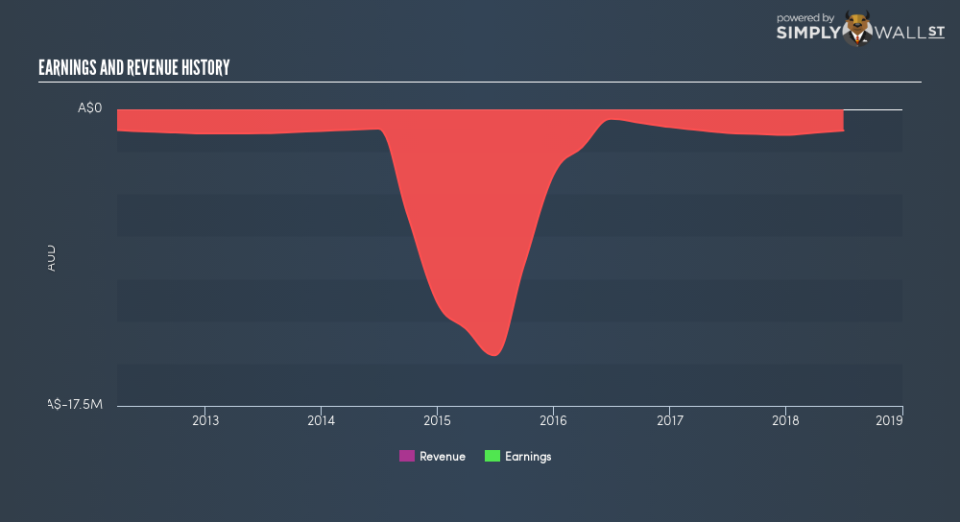

There are multiple explanations for why institutions don’t own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. On the other hand, it’s always possible that professional investors are avoiding a company because they don’t think it’s the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Lincoln Minerals, for yourself, below.

We note that hedge funds don’t have a meaningful investment in Lincoln Minerals. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Lincoln Minerals

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Lincoln Minerals Limited. Insiders own AU$1.2m worth of shares in the AU$4.0m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 26% ownership, the general public have some degree of sway over LML. While this group can’t necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 44%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it’s hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It’s always worth thinking about the different groups who own shares in a company. But to understand Lincoln Minerals better, we need to consider many other factors.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

If you would prefer check out another company — one with potentially superior financials — then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.