Commodities Technical Analysis, July 3rd – July 7th, 2017

Among other markets, commodities formed an interesting trade action during the previous week. Gold ‘Flash crash’ was a major event although gold was trading relatively clam beside the bizarre event. Crude oil prices bounced back to trade higher as reports confirmed that oil supply decreased.

The technical analysis, that includes the indicators’ data and major pivot points for WTI Oil, Gold, Silver and Copper as traded on spot market as of July 2nd, 2017:

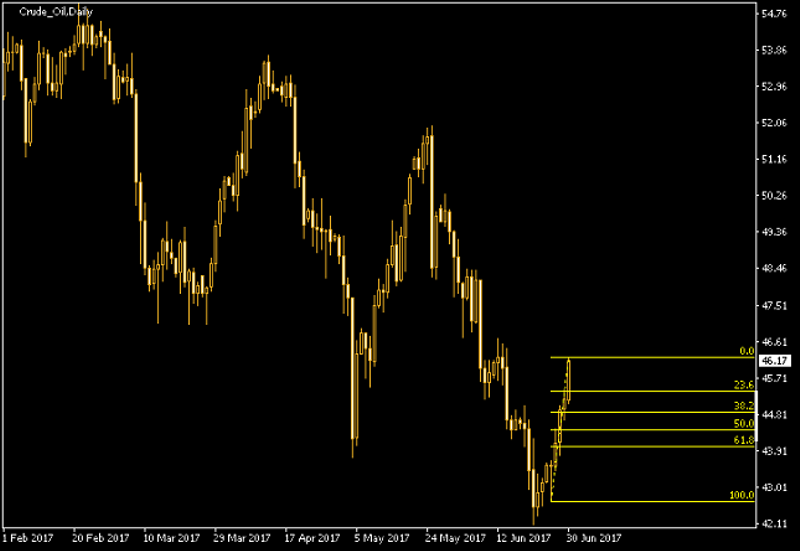

Crude Oil

Indicators

Short | Neutral | Long | Long |

Floor Pivot Points

40.21 | 41.43 | 43.80 | 45.02 | 47.39 | 48.61 | 50.98 |

Fibonacci Retracement Levels

42.65 | 43.50 | 44.02 | 44.45 | 44.87 | 46.24 |

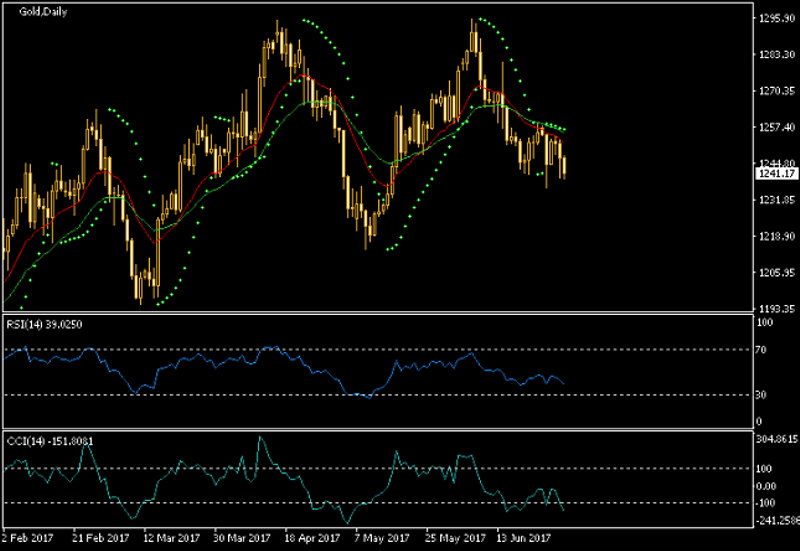

Gold

Indicators

Short | Neutral | Short | Short |

Floor Pivot Points

1214.69 | 1225.45 | 1233.31 | 1244.07 | 1251.93 | 1262.69 | 1270.55 |

Fibonacci Retracement Levels

1236.21 | 1240.60 | 1243.32 | 1245.52 | 1247.72 | 1254.83 |

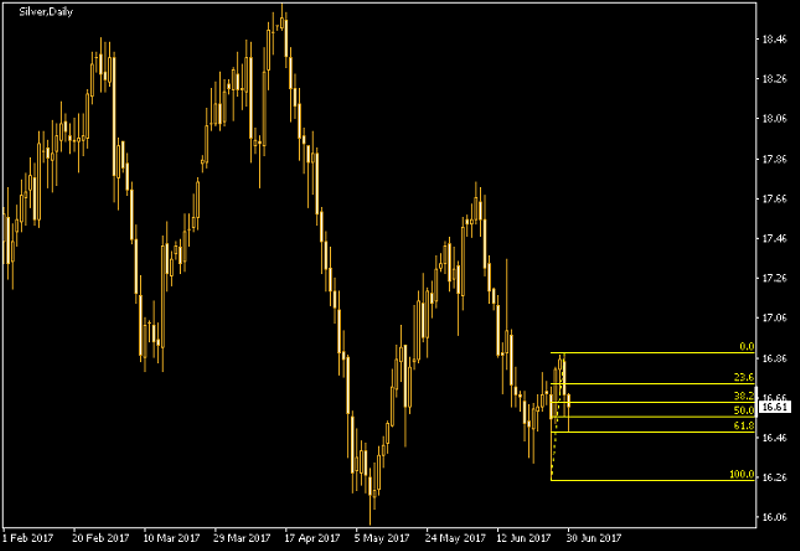

Silver

Indicators

Short | Neutral | Long | Neutral |

Floor Pivot Points

15.63 | 15.94 | 16.27 | 16.58 | 16.91 | 17.22 | 17.55 |

Fibonacci Retracement Levels

16.24 | 16.39 | 16.48 | 16.56 | 16.64 | 16.88 |

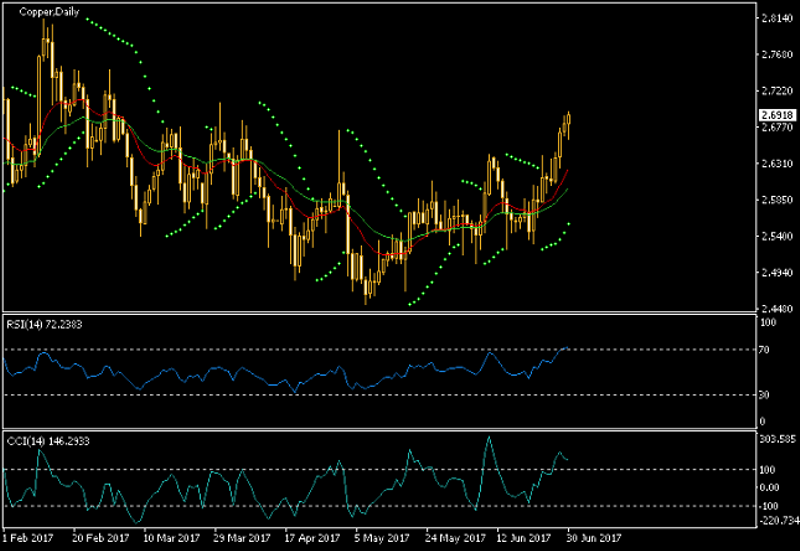

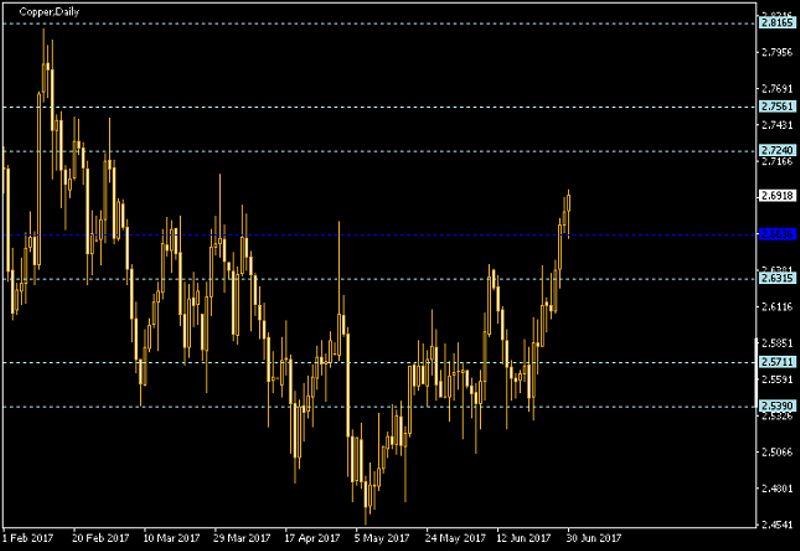

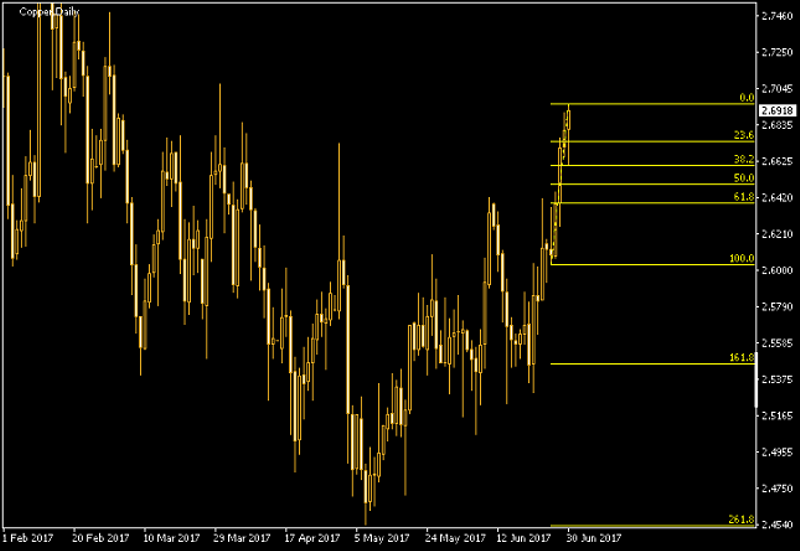

Copper

Indicators

Long | Overbought | Long | Long |

Floor Pivot Points

253.90 | 257.11 | 263.15 | 266.36 | 272.40 | 275.61 | 281.65 |

Fibonacci Retracement Levels

260.33 | 262.51 | 263.86 | 264.96 | 266.05 | 269.58 |

This post was originally published by EarnForex

This article was originally posted on FX Empire