Cautious Investors Not Rewarding Little Green Pharma Ltd's (ASX:LGP) Performance Completely

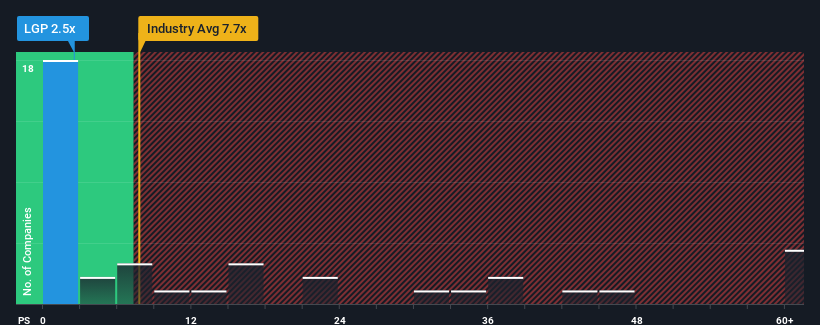

You may think that with a price-to-sales (or "P/S") ratio of 2.5x Little Green Pharma Ltd (ASX:LGP) is definitely a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in Australia have P/S ratios greater than 7.7x and even P/S above 29x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Little Green Pharma

What Does Little Green Pharma's Recent Performance Look Like?

Recent times haven't been great for Little Green Pharma as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Little Green Pharma.

How Is Little Green Pharma's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Little Green Pharma's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 41%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 44% per annum during the coming three years according to the one analyst following the company. With the industry only predicted to deliver 19% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Little Green Pharma is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Little Green Pharma's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Little Green Pharma, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.