Is BT Group plc’s (LON:BT.A) CEO Pay Fair?

Gavin Patterson has been the CEO of BT Group plc (LON:BT.A) since 2013. First, this article will compare CEO compensation with compensation at other large companies. Next, we’ll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for BT Group

How Does Gavin Patterson’s Compensation Compare With Similar Sized Companies?

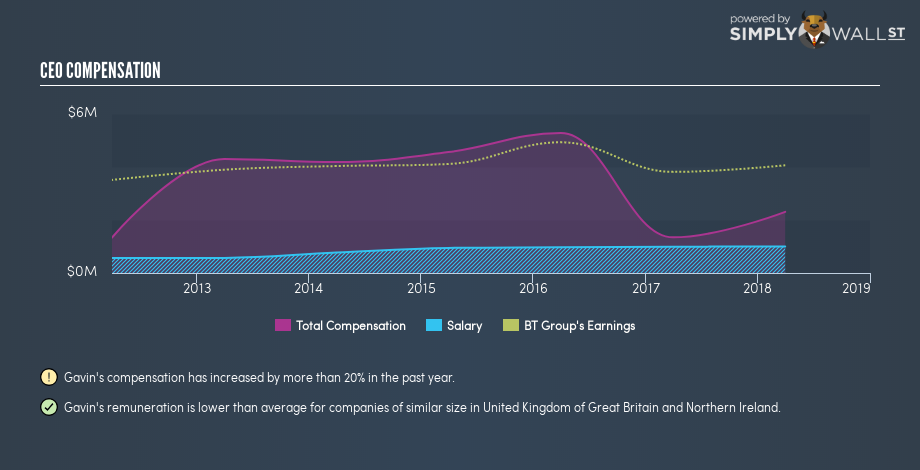

At the time of writing our data says that BT Group plc has a market cap of UK£23b, and is paying total annual CEO compensation of UK£2.3m. (This is based on the year to 2018). While this analysis focuses on total compensation, it’s worth noting the salary is lower, valued at UK£997k. We looked at a group of companies with market capitalizations over UK£6.3b and the median CEO compensation was UK£4.0m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts – even though some are quite a bit bigger than others).

Most shareholders would consider it a positive that Gavin Patterson takes less compensation than the CEOs of most other large companies, leaving more for shareholders. Though positive, it’s important we delve into the performance of the actual business.

The graphic below shows how CEO compensation at BT Group has changed from year to year.

Is BT Group plc Growing?

On average over the last three years, BT Group plc has shrunk earnings per share by 15% each year. In the last year, its revenue is down -2.1%.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO.

It could be important to check this free visual depiction of what analysts expect for the future.

Has BT Group plc Been A Good Investment?

With a three year total loss of 41%, BT Group plc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary…

It looks like BT Group plc pays its CEO less than the average at large companies.

Shareholders should note that compensation for Gavin Patterson is below the median of larger companies. But then, EPS growth is lacking and so are the returns to shareholders. Considering all these factors, we’d stop short of saying the CEO pay is too high, but we don’t think shareholders would want to see a pay rise before business performance improves. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling BT Group (free visualization of insider trades).

Or you might prefer this data-rich interactive visualization of historic revenue and earnings.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.