Brazil Maintains Benchmark Rate Amid Economic Distress

DailyFX.com -

Talking Points:

Brazil’s Central Bank maintains lending rate and elects a new president

Inflation data for May shows another jump of 4 basis points from April

BCB says mounting inflation doesn’t allow for flexible monetary policy

Having trouble trading in the FX markets? This may be why.

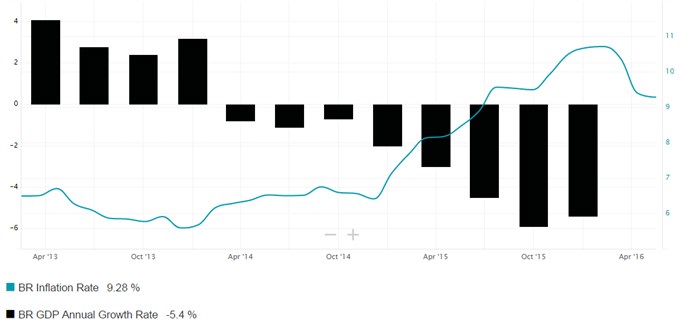

The Central Bank of Brazil (BCB) maintained its record-high lending rate at 14.25 percent as a new president is given the reigns to fight the country’s mounting inflation problem. Data released this morning showed that inflation continued its climb in May to 9.32 percent, from 9.28 in April.

The newly-elected BCB President Ilan Golfajn has been given the task of fighting Brazil’s recession and rising unemployment rate. This job is made far harder by the country’s ever-growing inflation rate, which is both well above the central bank’s target of 4.5 percent and their upper limit of 6.5 percent. The BCB said that “High inflation does not allow more flexible monetary policy.”

Brazil’s exports are mostly made up of a variety of commodities, the top 3 being iron ore, crude oil and soybeans. Falling commodity prices over the last year have negatively impacted the economy, with companies being hurt by low profits and a significantly stronger Brazilian Real. The rate decision today was expected as the central bank makes key staff changes. However, moving forward it will be important to see what policy measures the central bank supports as its hands remain tied by inflation.

Source: ieconomics.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.