April Top Dividend Stock

China Aoyuan Property Group is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

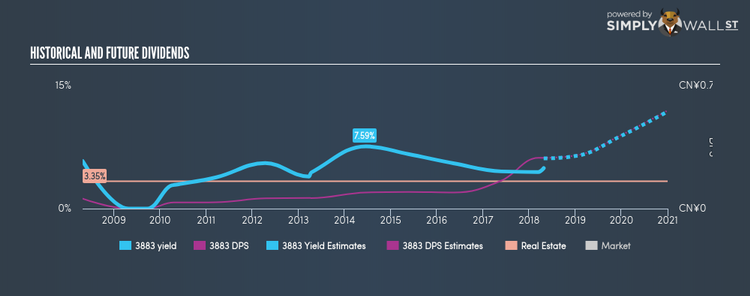

China Aoyuan Property Group Limited (SEHK:3883)

China Aoyuan Property Group Limited, an investment holding company, engages in the property development and investment activities in the People’s Republic of China and internationally. Formed in 1996, and run by CEO Zi Ning Guo, the company now has 7,211 employees and has a market cap of HKD HK$16.81B, putting it in the large-cap stocks category.

3883 has a sumptuous dividend yield of 4.94% and is distributing 40.75% of earnings as dividends . Although investors would have seen a few years of reduced payments, it has picked up again, with dividends increasing from CN¥0.061 to CN¥0.31 over the past 10 years. Analysts are expecting an impressive triple digit earnings growth over the next three years. More detail on China Aoyuan Property Group here.

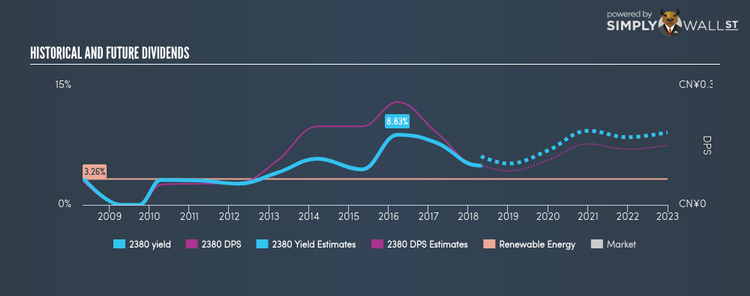

China Power International Development Limited (SEHK:2380)

China Power International Development Limited, together with its subsidiaries, develops, constructs, owns, operates, and manages power plants; and generates and sells electricity in the People’s Republic of China. Founded in 2004, and now run by , the company employs 9,780 people and has a market cap of HKD HK$20.01B, putting it in the large-cap category.

2380 has a juicy dividend yield of 4.92% and has a payout ratio of 81.04% . Despite some volatility in the yield, DPS has risen in the last 10 years from CN¥0.06 to CN¥0.10. China Power International Development is also a strong prospect for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next three years. Continue research on China Power International Development here.

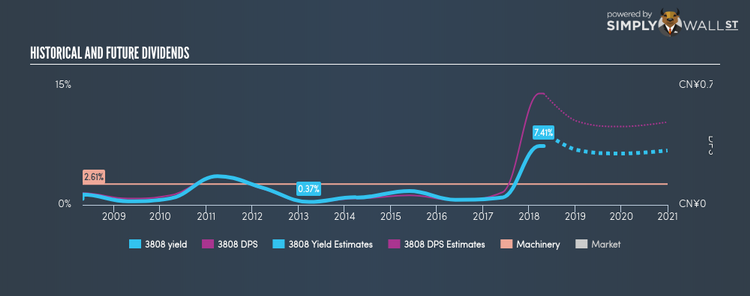

Sinotruk (Hong Kong) Limited (SEHK:3808)

Sinotruk (Hong Kong) Limited, an investment holding company, engages in the research, development, manufacture, and sale of heavy duty trucks (HDTs), light duty trucks, buses, and related parts in Mainland China and internationally. Formed in 2007, and headed by CEO Dong Cai, the company currently employs 24,819 people and with the company’s market capitalisation at HKD HK$26.09B, we can put it in the large-cap group.

3808 has a substantial dividend yield of 7.41% and pays 53.24% of its earnings as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. More detail on Sinotruk (Hong Kong) here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.