The a2 Milk Company Limited (ASX:A2M) And The Consumer Discretionary Sector Outlook 2017

The a2 Milk Company Limited (ASX:A2M), a AUD$4.05B mid-cap, is a consumer staples company operating in an industry which has been a consistent performer over time due to its robust consumer demand throughout economic cycles. However, the key uncertainty facing the food product industry specifically is around the change in consumer taste and growth in customer expectation from food producers. The demand is still there but the game is changing – pressure for organic, sustainably sourced, ethically traded and healthy food is growing, spurred by millennials and more conscious consumers. Consumer staple analysts are forecasting for the entire industry, a strong double-digit growth of 26 percent in the upcoming year, and a whopping growth of 59 percent over the next couple of years. Not surprisingly, this rate is more than double the growth rate of the Australian stock market as a whole. Is now the right time to pick up some shares in food product companies? Today, I will analyse the industry outlook, and also determine whether A2M is a laggard or leader relative to its consumer staples sector peers. See our latest analysis for A2M

What’s the catalyst for A2M's sector growth?

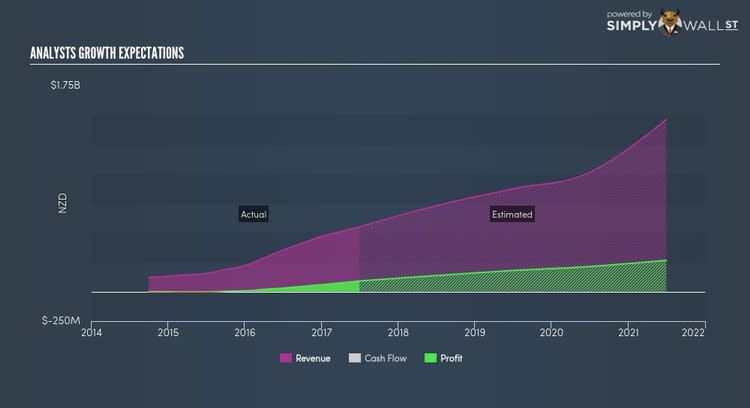

Disruption from consumers is becoming more prominent than that of industry competitors. Consumers are predominantly leaning towards more health-conscious alternatives such as whole and raw ingredients. Additionally, new companies with unique business models have emerged in the wake of this healthier food trend. In the previous year, the industry saw growth of over 50 percent, beating the Australian market growth of 6 percent. A2M leads the pack with its impressive earnings growth of over 100 percent last year. Furthermore, analysts are expecting this trend of above-industry growth to continue, with A2M poised to deliver a triple digit growth over the next couple of years. This growth may make A2M a more expensive stock relative to its peers.

Is A2M and the sector relatively cheap?

The food product sector's PE is currently hovering around 29 times, higher than the rest of the Australian stock market PE of 22 times. This means the industry, on average, is relatively expensive compared to the wider market. However, the industry did return a higher 26 percent compared to the market’s 16 percent, which may be indicative of past tailwinds. On the stock-level, A2M is trading at a higher PE ratio of 47 times, making it more expensive than the average food product stock. In terms of returns, A2M generated 48 percent in the past year, which is 22 percent over the food product sector.

What this means for you:

Are you a shareholder? A2M’s industry-beating future is a positive for shareholders, indicating they’ve backed a fast-growing horse. However, this higher growth prospect is also reflected in A2M’s high price, suggested by its higher PE ratio relative to its peers. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto A2M as part of your portfolio. However, if you’re relatively concentrated in food product, the A2M’s high PE may signal the right time to sell.

Are you a potential investor? If A2M has been on your watchlist for a while, now may not be the best time to enter into the stock since it is trading at a higher valuation compared to other food product companies. However, that being said, its industry-beating growth prospects may be the reason for high relative valuation. I suggest you look at A2M’s future cash flows in order to assess whether the stock is trading at a reasonable price on this basis.

For a deeper dive into a2 Milk's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other consumer staples stocks instead? Use our free playform to see my list of over 100 other consumer staples companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.