2 Days Left Before Kingdom Holdings Limited (HKG:528) Will Start Trading Ex-Dividend, Should You Buy?

Investors who want to cash in on Kingdom Holdings Limited’s (SEHK:528) upcoming dividend of CN¥0.02 per share have only 2 days left to buy the shares before its ex-dividend date, 05 June 2018, in time for dividends payable on the 06 July 2018. Is this future income a persuasive enough catalyst for investors to think about Kingdom Holdings as an investment today? Below, I’m going to look at the latest data and analyze the stock and its dividend property in further detail. View our latest analysis for Kingdom Holdings

Here’s how I find good dividend stocks

When assessing a stock as a potential addition to my dividend Portfolio, I look at these five areas:

Is it paying an annual yield above 75% of dividend payers?

Has its dividend been stable over the past (i.e. no missed payments or significant payout cuts)?

Has dividend per share risen in the past couple of years?

Is is able to pay the current rate of dividends from its earnings?

Based on future earnings growth, will it be able to continue to payout dividend at the current rate?

Does Kingdom Holdings pass our checks?

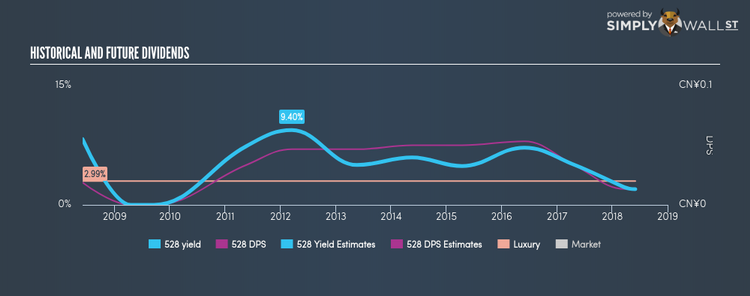

Kingdom Holdings has a negative payout ratio, meaning that the company is not yet profitable and is paying dividend by dipping into its retained earnings. If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. Dividend payments from Kingdom Holdings have been volatile in the past 10 years, with some years experiencing significant drops of over 25%. These characteristics do not bode well for income investors seeking reliable stream of dividends. Compared to its peers, Kingdom Holdings generates a yield of 1.98%, which is on the low-side for Luxury stocks.

Next Steps:

Now you know to keep in mind the reason why investors should be careful investing in Kingdom Holdings for the dividend. But if you are not exclusively a dividend investor, the stock could still be an interesting investment opportunity. Given that this is purely a dividend analysis, you should always research extensively before deciding whether or not a stock is an appropriate investment for you. I always recommend analysing the company’s fundamentals and underlying business before making an investment decision. I’ve put together three important factors you should further examine:

Valuation: What is 528 worth today? Even if the stock is a cash cow, it’s not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether 528 is currently mispriced by the market.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Kingdom Holdings’s board and the CEO’s back ground.

Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.