Zillow: iBuying Pause, Website Traffic, Earnings and More

In mid-October, Zillow (ZG) announced it was putting the brakes on its Zillow Offers iBuying program until the end of 2021. As Zillow repairs the homes it purchases before reselling them, while there has been strong demand, there has also been an acute worker shortage, which has caused a backlog in renovations. These along with capacity constraints have been cited as the reasons for the pause.

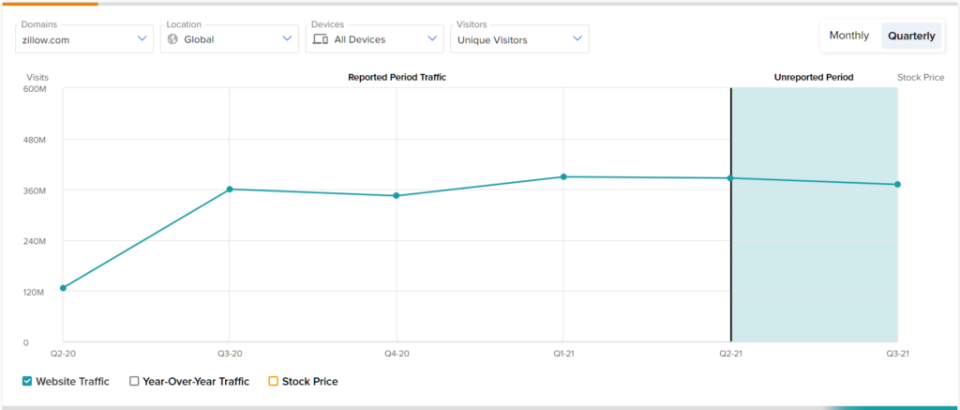

Interestingly, looking at Zillow’s website traffic, the announcement followed on from a sharp drop in month-over-month unique visitors (UVs) to the Zillow website. These fell by 8% between August and September. Overall, in Q3 there was a 4% decline to UVs from 386.6 million in Q2 to 371.8 million. While traffic is still better than it was a year ago, year-over-year UVs growth is also slowing down; from 8% between 2Q20 and 2Q21 to 3% between 3Q20 to 3Q21.

How these developments will affect 3Q21’s earnings when the real estate tech company reports on Tuesday (Nov 2, AMC) remains to be seen, although Zillow will have to follow a record-breaking previous quarter.

“Recall,” said Truist analyst Naved Khan, “Zillow Offers saw record revenue and home purchase activity in 2Q21, with Homes revenue of $771 million and a total of 2,086 homes sold.” Khan views the hiatus in home buying as a “temporary setback and part of ‘growing pains’” in the iBuyer segment, driven both by internal and external factors.

To efficiently scale and manage iBuyer operations, Zillow is currently in the process of building a tech stack to streamline proceedings. Add in the labor shortages causing “bottlenecks along the chain” and in such an environment, says the 5-star analyst, “The current pause lowers inventory risk.” The halt on purchases will put a cap on volumes through 1H22, but the analyst believes upon relaunch, operations will be more efficient as the tech rollout “progresses.”

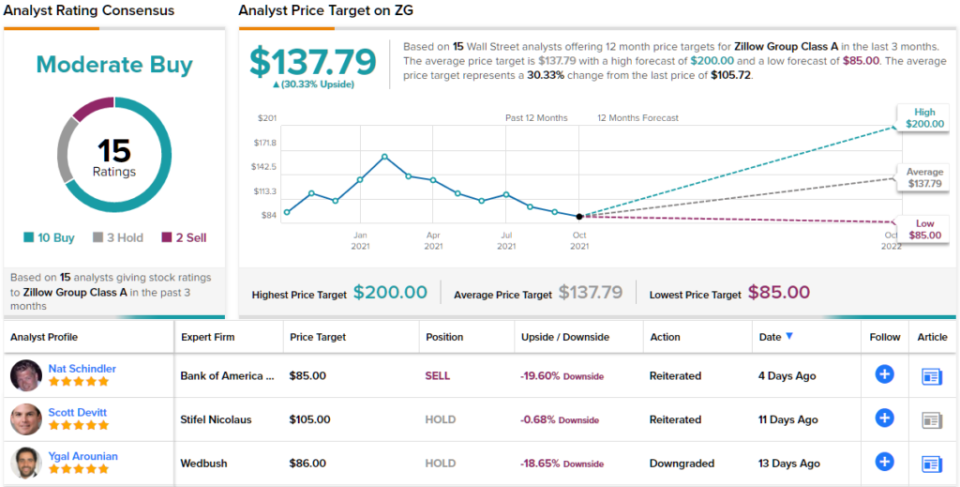

However, the pause does not affect Khan’s long-term view of the business. In fact, the analyst believes shares are significantly undervalued. Khan’s $200 price target suggests the stock will provide returns of 89% over the one-year timeframe. No need to add, Khan’s rating stays a Buy. (To watch Khan’s track record, click here)

The Street’s average target is a more modest $137.79 yet could still provide investors with share gains of 30%. Zillow retains the support of most Street analysts although not all are on board; based on 10 Buys vs. 3 Holds and 2 Sells, the stock has a Moderate Buy consensus rating. (See Zillow stock analysis on TipRanks)

To find publicly traded companies with trending websites (i.e. top websites which have the highest website traffic increases over the past month), visit TipRanks’ Website Traffic Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.