Why Crown Holdings Stock Jumped Today

Shares of packaging company Crown Holdings (NYSE: CCK) jumped on Tuesday after the company reported financial results for the first quarter of 2024. As of 11:15 a.m. ET, Crown Holdings stock was up about 3% but had been up by nearly 6% earlier in the day.

Lower sales but higher shipments

In Q1, net sales for Crown Holdings were down 6% year over year to about $2.8 billion. That would be discouraging without context.

The encouraging context is that the company has deals with certain customers that pass on fluctuations in material costs. This negatively impacted sales in Q1. But shipments were up, including a 2.5% increase for beverage-can shipments, arguably the more important metric.

On the bottom line, Crown Holdings' Q1 net income dropped by nearly 24% to $93 million. This translated into earnings per share (EPS) of $0.56. But even though this was a decrease, analysts weren't too upset because this is about what they expected.

Moreover, management for Crown Holdings kept its full-year adjusted EPS guidance unchanged at $5.80 to $6.20. By keeping the guidance unchanged, management communicated that the business is on track for the year despite the drop in Q1.

An average stock?

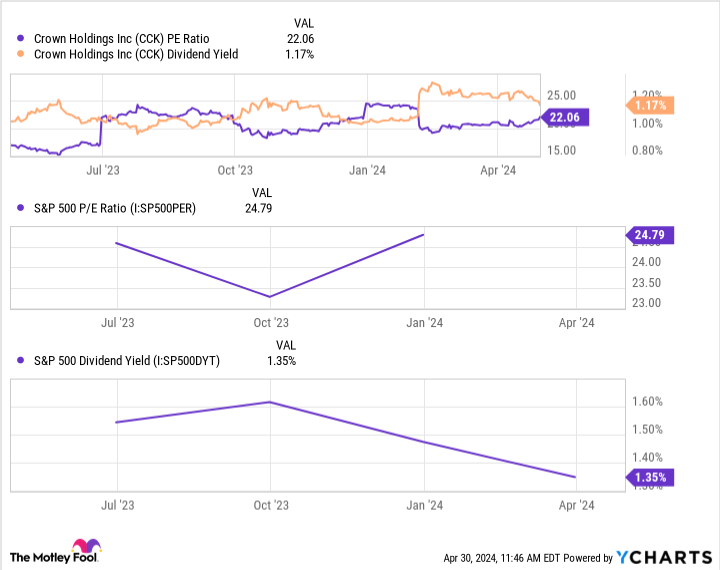

As of this writing, Crown Holdings stock trades at about 22 times its trailing earnings, which is close to the average for the S&P 500. Moreover, the company's dividend yield of 1.2% is also about average.

It may be fair to say that Crown Holdings stock trades at a reasonable valuation when compared to the S&P 500. But given Crown Holdings' modest growth prospects and challenges with profitability, I don't believe its stock presents a compelling buying opportunity today. There are likely many other safe stocks that offer better upside potential.

Should you invest $1,000 in Crown right now?

Before you buy stock in Crown, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Crown wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,692!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Crown Holdings Stock Jumped Today was originally published by The Motley Fool