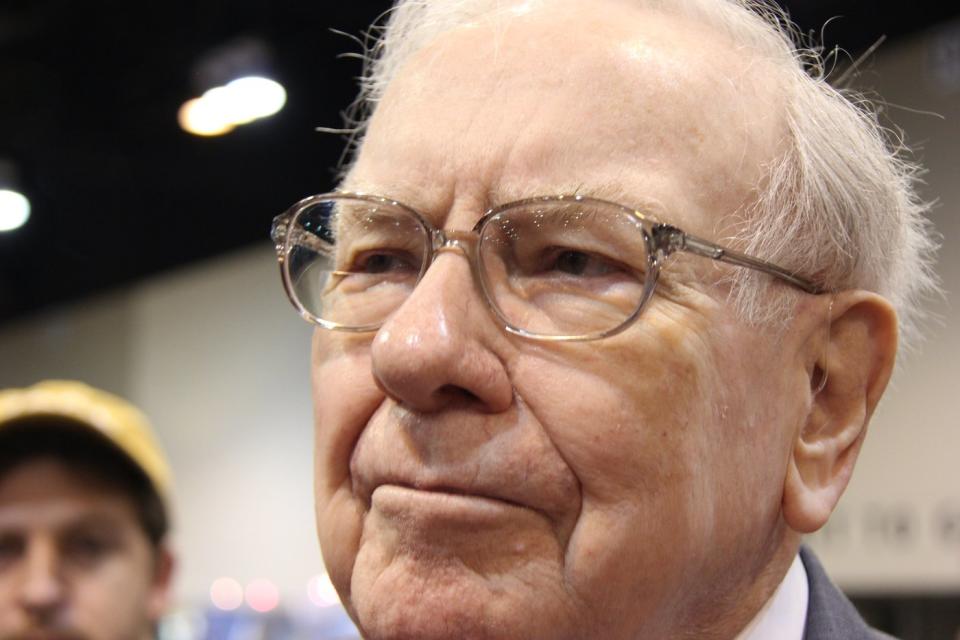

Warren Buffett Bought $9.2 Billion of This Stock Last Year, and He Could Buy Even More in 2024

There are a lot of good reasons to pay attention to every investment decision Warren Buffett makes.

Besides being the chairman and CEO of the eighth largest public company in the world, Buffett has an impressive track record as an investor. Since taking control of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) in 1965, he's grown the value of the business, including its investments, by a compound annual growth rate of 19.8%. That compares with the 10.2% compound total return of the S&P 500 index during that time. Anyone who invested in Berkshire instead of an average S&P 500 fund would have 140 times the amount of wealth today.

In recent years, Buffett has been hard-pressed to find a great company to buy. As Berkshire Hathaway grows larger, its operations spin off more cash, and Buffett has seen the company's cash pile grow faster than he can find good investments. His largest investment last year totaled $9.2 billion, while the company ended the year with $167.6 billion.

It's a good bet Buffett will continue to snatch up shares of the company this year, as he sees it as undervalued in today's market.

Buffett's biggest investment last year

As mentioned, Buffett hasn't seen a whole lot to like in the stock market over the past year, so his new investments have been few and far between.

One stock that he consistently added to in 2023 and continues to buy in 2024, though, is Occidental Petroleum (NYSE: OXY). The company holds a strong position in the Permian Basin, giving it access to some of the lowest-cost oil supply in the country. Berkshire Hathaway first invested in Occidental with the purchase of $10 billion in preferred shares in 2019 to support the oil company's purchase of Anadarko. Buffett has since taken a massive 28% stake in the company through its common stock, more than offsetting Occidental's retirement of his preferred shares over the past year. Still, Buffett's Occidental purchases in 2023 only added up to about $3 billion.

There's another company Buffett bought a significant stake in last year as well. However, we still don't know exactly what it is. While Berkshire Hathaway is typically required to disclose every position in its portfolio at the end of each quarter, it received a special exemption from the SEC for the last two quarters of 2023. As a result, we don't know exactly what Buffett's been purchasing.

But we do have some clues. First of all, the company appears to be a financial stock, based on Berkshire Hathaway's reported cost basis of "banks, insurance, and finance" equities. Second, Berkshire's financial disclosures indicate it invested over $5 billion in the stock in 2023. That means the company must be very large, considering Berkshire is required to disclose the company after amassing a 5% stake in the business. My colleague Sean Williams narrowed the field to just seven potential candidates, his best guess being Mitsubishi UFJ Financial Group. Since Berkshire asked for the position to remain confidential, investors can bet he's planning to buy more in 2024.

Still, both those investments pale in comparison to the amount Buffett spent on his largest purchase in 2023. Buffett spent $9.2 billion buying shares in one of his favorite stocks. His first purchase of the company's stock dates to 1962. Yes, Buffett's biggest stock purchase for Berkshire Hathaway shareholders last year was Berkshire Hathaway stock itself!

Buffett's buyback philosophy

Berkshire Hathaway's board of directors previously restricted Buffett's ability to buy back shares based on the stock's price-to-book-value ratio. If the ratio exceeded 1.2, Buffett couldn't buy back any shares of Berkshire Hathaway no matter how much he felt the market was undervaluing the stock.

In mid-2018, the board agreed to allow Buffett to buy shares of Berkshire Hathaway as long as both he and late Vice Chairman Charlie Munger agreed the stock was priced below its intrinsic value based on a conservative estimate.

Since Munger's passing, Buffett has become the sole determinant of the stock's intrinsic value. But investors shouldn't worry that he wields too much power. Buffett is adamant that management should never overpay to buy back its stock. He laid it out plainly in his most recent letter to shareholders: "All stock repurchases should be price-dependent. What is sensible at a discount to business value becomes stupid if done at a premium."

What's more, Buffett holds about 99% of his wealth in Berkshire Hathaway stock, and he has many family members with significant amounts of their wealth in Berkshire stock. He only ever disposes of shares when he donates them to charity. His interests couldn't be more aligned with the rest of Berkshire's shareholders.

Nonetheless, Buffett has bought back shares of Berkshire Hathaway every quarter since the board authorized the change. That includes $9.2 billion worth last year.

Considering Berkshire Hathaway has been producing strong operating results from its wholly owned businesses, generating billions in free cash flow every quarter, it's very likely Buffett will continue to buy shares in 2024. Berkshire Hathaway stock currently trades for just 17.5 times forward earnings estimates. That's well below the S&P 500's forward P/E of 20.8. And when you consider the amount of cash on its balance sheet, that ratio looks even more appealing.

So Buffett would be more than justified in his continued repurchase of Berkshire Hathaway stock. We'll find out on Saturday, when Berkshire Hathaway releases its quarterly report, if Buffett bought more shares during the first three months of the year. And if you'd like a growing share of a company Buffett thinks is undervalued, you might consider adding some of the stock to your own portfolio.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Bought $9.2 Billion of This Stock Last Year, and He Could Buy Even More in 2024 was originally published by The Motley Fool