Two Compelling Investments for the Year Ahead

By: PIMCO

Harvest Exchange

February 28, 2017

Two Compelling Investments for the Year Ahead

Many typical investments don’t seem to offer much of a bargain these days. Government bond yields are well below long-term averages, thanks in part to the secular economic environment that PIMCO has dubbed The New Neutral, but also thanks to major central banks having suppressed long-term interest rates via ultra-low (sometimes negative) policy rates and asset purchases. Meanwhile, risk assets such as stocks and corporate bonds are trading near their long-term averages (according to the equity risk premium of the S&P 500 Index since 1950 and the option-adjusted spread above like-maturity Treasuries of the Bloomberg Barclays U.S. Credit Index (investment grade) since 1973), suggesting little room for major upside gains over the long run.

This environment has led many investors to reduce their expectations for future returns from traditional assets such as developed market stocks and bonds. Indeed, it raises the question of whether any attractively priced assets remain. That is, what is still “cheap”?

In our opinion, at least two tradable variables are currently cheap (by which we mean substantially underpriced compared with both historical averages as well as our expectations for the future) and could be used to potentially enhance portfolio outcomes: volatility and inflation risk. While these are not the only investment opportunities in the market, we believe they stand out as poised to deliver enhanced return potential and other structural benefits, such as diversification and improved Sharpe ratios. (For our detailed outlook on asset classes and investment risks and opportunities in 2017, read “Tails and Transitions.”)

The volatility opportunity

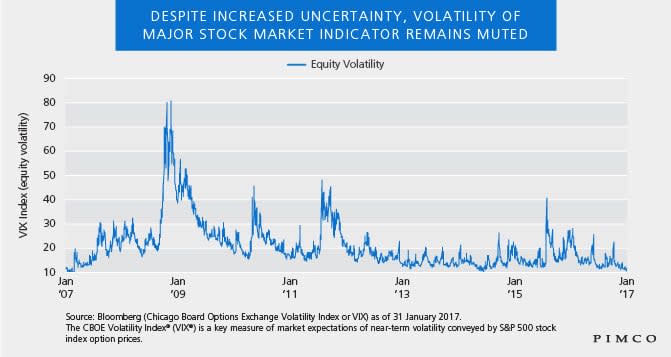

Stock market volatility is near its lowest levels of the past decade (see chart below). We see a couple of explanations. The first is based on fundamentals: Many investors are focusing on potential right-tail outcomes (that is, the likelihood of positive or upside market surprises) of deregulation, tax reform and fiscal stimulus under new U.S. political leadership while ignoring potential left-tail outcomes of trade wars, geopolitical flare-ups or policy errors.

The second reason we see for reduced stock market volatility is based on technicals: Dispersion in equity returns has increased. In other words, we now have some winners and some losers rather than a market where all stocks move up or down in unison. This greater dispersion among the components of an index – with winners and losers often offsetting each other – tends to decrease overall volatility at the index level.

We think today’s cheap implied volatility may allow for the use of option strategies in an optimal way, either to hedge downside (bearish) risks or to express bullish views in a cost-effective and risk-managed fashion. Either way, we feel the current price of the volatility trade is attractive.

The inflation trade

Market-priced expectations suggest, in our view, that investors don’t believe U.S. inflation rates will rise as quickly or as high as we at PIMCO believe is likely. See chart below, where the blue line shows market expectations for the annualized inflation rate (as measured by the U.S. Consumer Price Index or CPI) over a five-year period starting five years from now. The green line is the historical average for this measure and the orange line is the Federal Reserve’s effective target for the U.S. inflation rate.

What we find surprising is that many of the new U.S. administration’s suggested policies – tax cuts, infrastructure spending, tariffs on imports, reduced immigration – would all tend to increase inflation, yet the market for Treasury Inflation-Protected Securities (TIPS) seems to imply that the Fed will not achieve its inflation target. What’s happening here? First, we believe investors are demanding a liquidity premium for investing in TIPS rather than nominal U.S. Treasuries. Second, investors have been conditioned by the experience of the past several years, when deflation was the bigger risk than rising inflation, and they are not yet ready to price a positive inflation risk premium in the market.

Given current valuations and the increased possibility of higher inflation (either through the U.S. economy overheating or even a period of stagflation), we believe including TIPS in a portfolio improves its resilience and performance potential over a greater set of economic outcomes. We feel investors should consider increasing their exposure to inflation-hedging assets, independent of their growth outlook.

To summarize, in a world where many assets are priced for perfection – whether overpriced or just fairly priced at best – we feel volatility and inflation hedges are still currently attractively priced or cheap. We find option strategies and inflation-hedging assets like TIPS are attractive tools to improve portfolio construction in this environment.

Visit PIMCO’s asset allocation page to learn more about where PIMCO sees value across global asset classes.

Mihir Worah is PIMCO’s CIO Asset Allocation and Real Return, and a regular contributor to the PIMCO Blog.

http://hvst.co/2ll8ekS

Originally Published at: Two Compelling Investments for the Year Ahead