What You Must Know About Tye Soon Limited’s (SGX:BFU) Return on Equity

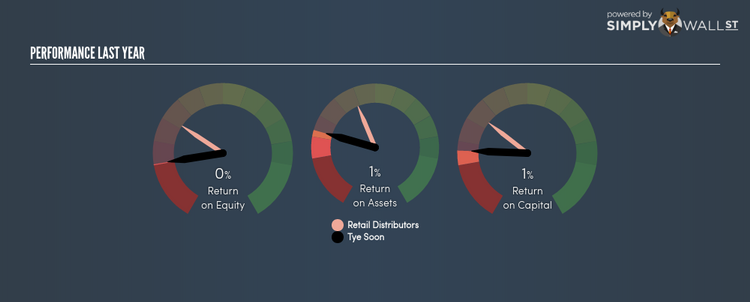

Tye Soon Limited (SGX:BFU) generated a below-average return on equity of 0.14% in the past 12 months, while its industry returned 6.98%. An investor may attribute an inferior ROE to a relatively inefficient performance, and whilst this can often be the case, knowing the nuts and bolts of the ROE calculation may change that perspective and give you a deeper insight into BFU’s past performance. Today I will look at how components such as financial leverage can influence ROE which may impact the sustainability of BFU’s returns. View our latest analysis for Tye Soon

Peeling the layers of ROE – trisecting a company’s profitability

Firstly, Return on Equity, or ROE, is simply the percentage of last years’ earning against the book value of shareholders’ equity. For example, if the company invests SGD1 in the form of equity, it will generate SGD0 in earnings from this. In most cases, a higher ROE is preferred; however, there are many other factors we must consider prior to making any investment decisions.

Return on Equity = Net Profit ÷ Shareholders Equity

ROE is assessed against cost of equity, which is measured using the Capital Asset Pricing Model (CAPM) – but let’s not dive into the details of that today. For now, let’s just look at the cost of equity number for Tye Soon, which is 18.12%. Since Tye Soon’s return does not cover its cost, with a difference of -17.98%, this means its current use of equity is not efficient and not sustainable. Very simply, Tye Soon pays more for its capital than what it generates in return. ROE can be dissected into three distinct ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

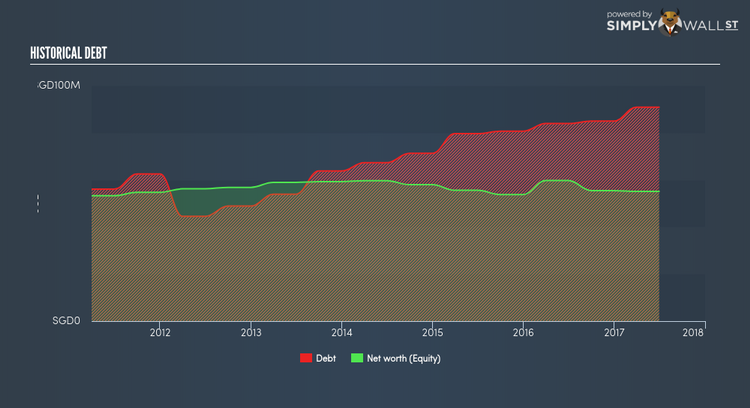

Essentially, profit margin shows how much money the company makes after paying for all its expenses. The other component, asset turnover, illustrates how much revenue Tye Soon can make from its asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. Since ROE can be artificially increased through excessive borrowing, we should check Tye Soon’s historic debt-to-equity ratio. Currently the debt-to-equity ratio stands at a high 164.98%, which means its below-average ROE is already being driven by significant debt levels.

What this means for you:

Are you a shareholder? BFU’s ROE is underwhelming relative to the industry average, and its returns were also not strong enough to cover its own cost of equity. Additionally, its high debt level appears to be a key driver of its ROE and is something you should be mindful of before adding more of BFU to your portfolio. If you’re looking for new ideas for high-returning stocks, you should take a look at our free platform to see the list of stocks with Return on Equity over 20%.

Are you a potential investor? If BFU has been on your watch list for a while, making an investment decision based on ROE alone is unwise. I recommend you do additional fundamental analysis by looking through our most recent infographic report on Tye Soon to help you make a more informed investment decision.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.