Middlefield Banc Corp (NASDAQ:MBCN): Has Recent Earnings Growth Beaten Long-Term Trend?

In this commentary, I will examine Middlefield Banc Corp’s (NASDAQ:MBCN) latest earnings update (31 March 2018) and compare these figures against its performance over the past couple of years, as well as how the rest of the banks industry performed. As an investor, I find it beneficial to assess MBCN’s trend over the short-to-medium term in order to gauge whether or not the company is able to meet its goals, and ultimately sustainably grow over time. See our latest analysis for Middlefield Banc

Did MBCN’s recent earnings growth beat the long-term trend and the industry?

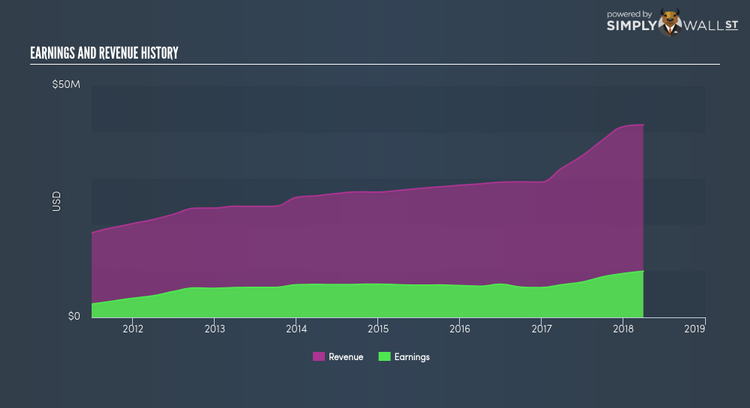

I like to use data from the most recent 12 months, which annualizes the most recent half-year data, or in some cases, the latest annual report is already the most recent financial year data. This method allows me to examine different stocks on a more comparable basis, using the latest information. For Middlefield Banc, its latest trailing-twelve-month earnings is US$9.96M, which, against the previous year’s level, has jumped up by 41.70%. Since these figures are fairly nearsighted, I have determined an annualized five-year value for MBCN’s net income, which stands at US$6.63M This shows that, on average, Middlefield Banc has been able to gradually raise its earnings over the last few years as well.

What’s the driver of this growth? Let’s take a look at whether it is merely attributable to industry tailwinds, or if Middlefield Banc has experienced some company-specific growth. The ascend in earnings seems to be supported by a strong top-line increase outstripping its growth rate of costs. Though this resulted in a margin contraction, it has made Middlefield Banc more profitable. Looking at growth from a sector-level, the US banks industry has been growing, albeit, at a unexciting single-digit rate of 8.49% in the prior year, and a substantial 10.95% over the previous five years. This means any uplift the industry is deriving benefit from, Middlefield Banc is able to leverage this to its advantage.

What does this mean?

While past data is useful, it doesn’t tell the whole story. Companies that have performed well in the past, such as Middlefield Banc gives investors conviction. However, the next step would be to assess whether the future looks as optimistic. You should continue to research Middlefield Banc to get a better picture of the stock by looking at:

Future Outlook: What are well-informed industry analysts predicting for MBCN’s future growth? Take a look at our free research report of analyst consensus for MBCN’s outlook.

Financial Health: Is MBCN’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 March 2018. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.