What is a Lot in Forex?

A lot refers to a bundle of units in trade. It essentially refers to the size of the trade that you are making.

Some examples of lots that you may be familiar with is at the grocery store. If you buy a 6-Pack of your favorite beverage you are essentially buying 1 lot. You see, you can’t buy 3 cans of the beverage; you have to purchase them as a full pack.

You can buy more than 6, by purchasing more ‘packs’, but you can only purchase them in multiples of 6. The 6-Pack is an example of a LOT. In Foreign Exchange, lots comprise how many units of currency in the trade.

The smallest lot available is a micro lot which is a bundle of 1,000 units of currency (often times referred to as 1k). This means the smallest trade size you can make is in multiples of 1k. You can trade 1k, 2k, 3k, or 138k just so long as it is in multiples of 1k. Each 1k is referred to as a lot.

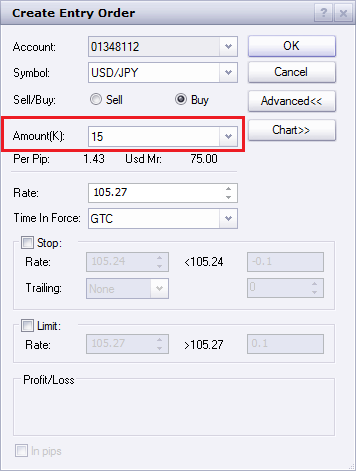

(Created using FXCM’s Trading Station II Desktop)

In the example above, the trader would be placing an order for 15 lots since the trade size is 15k or 15,000 units of currency. Essentially, by placing this order, the trader is stating “I want to buy 15 lots of US Dollars while selling the equivalent size in Japanese Yen.”

You may also hear terms like mini lots or standard lots. These are older FX terms that refer to larger trade sizes. Years ago, FX trading was conducted with a minimum trade size of 100k which was considered a standard lot. Then, as the big banks became better at processing the plethora of electronic trades from retail brokers, they were able to offer a mini lot which was 10k units of currency.

Eventually, the minimum trade size was lowered to 1k which is called a lot or micro lot.

FX trading has been around a long time and the big banks would exchange currencies in a special sized lot called “yard”. A yard of currency is 1 billion units.

Naturally, the more lots you trade, the greater risk you are taking on. Newer traders need to realize the impact their trade size has on their account equity. Too often, I’ve seen newer traders try to reduce risk on the trade by decreasing the distance of their stop loss. In many cases, the best way to reduce risk is to reduce the number of lots traded.

Open a free forex practice trading account and place two different trades with a different number of lots.

Try placing a trade on the EURUSD for 10 lots. Then, place another practice trade on the GBPUSD for 100 lots. Notice how GBPUSD moves quicker and is a risker trade because of more units exposed in the market.

Once you get comfortable with how the lot works, understanding forex trade sizes using notional value can bring more clarity as to why certain pairs may move more than others and why pip costs may differ drastically.

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education

Contact us at instructor@dailyfx.com if you are experiencing any difficulties with your free practice account or if you have questions about the two practice trades placed above.

Follow me on Twitter at @JWagnerFXTrader.

To be added to Jeremy’s e-mail distribution list, click HERE and select SUBSCRIBE then enter in your email information.

See Jeremy’s recent articles at his DailyFX Forex Educators Bio Page.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.