Jim Simons Doubles Down on REIT

Jim Simons (Trades, Portfolio), founded the hedge fund Renaissance Technologies in 1982, which he ran for 28 years before retiring in 2010.

Warning! GuruFocus has detected 8 Warning Signs with AVB. Click here to check it out.

The intrinsic value of AVB

In the third quarter of 2015, the fund added 410,014 shares of AvalonBay Communities Inc. (AVB). The fund now owns 860,414 shares of AvalonBay Communities.

AvalonBay Communities is also traded in Germany.

AvalonBay Communities was incorporated in California in 1978. In 1995, the company reincorporated in Maryland, becoming a real estate trust for federal income tax purposes. With the bold purpose of "creating a better way to live," AvalonBay Communities engages in acquiring multifamily communities located in secluded areas of the U.S.

The company has three philosophies contributing to their success: a commitment to integrity, a spirit of caring and a focus on continuous improvement.

I feel like these are strong principles in building a solid foundation for a growing company.

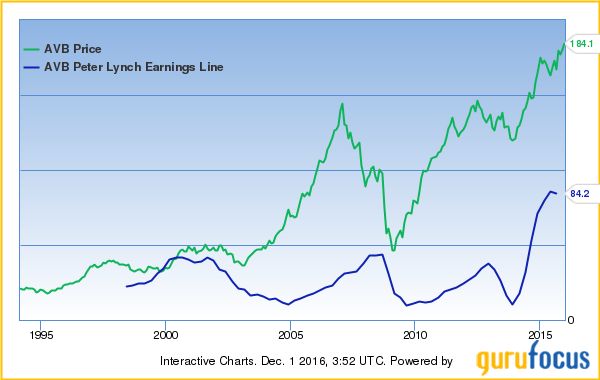

Below is a Peter Lynch chart for AvalonBay Communities Inc.

I like Simons' investment strategies, and the proof of his success is in the pudding. Simons is #32 on the Forbes 400 list with an estimated net worth of $14 billion.

I believe that this is a good company to invest in because everyone needs a roof over their heads, and AvalonBay Communities has an advantage of investing in communities with a difficult barrier of entry.

Cheers to your investment success.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 8 Warning Signs with AVB. Click here to check it out.

The intrinsic value of AVB