Introducing Prinx Chengshan (Cayman) Holding (HKG:1809), A Stock That Climbed 43% In The Last Year

It's been a soft week for Prinx Chengshan (Cayman) Holding Limited (HKG:1809) shares, which are down 16%. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 43%.

View our latest analysis for Prinx Chengshan (Cayman) Holding

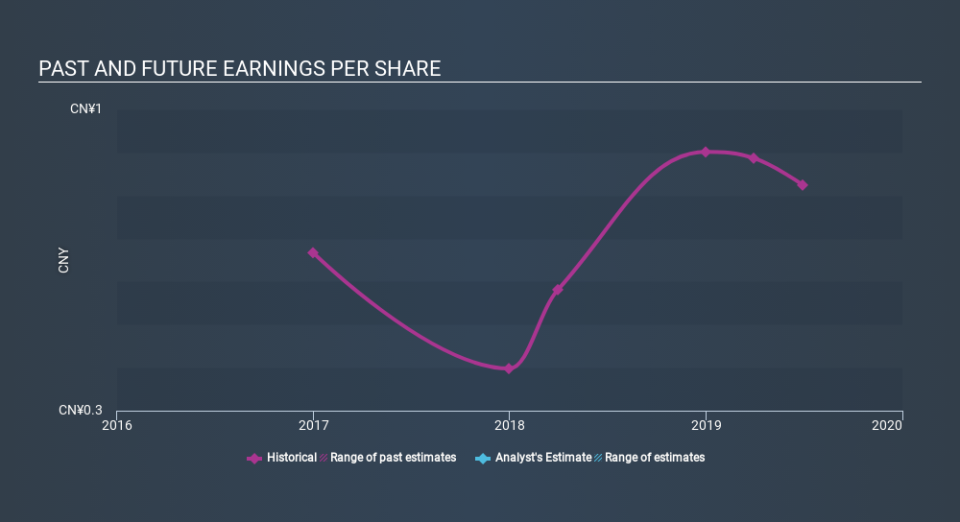

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Prinx Chengshan (Cayman) Holding grew its earnings per share (EPS) by 20%. The share price gain of 43% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Prinx Chengshan (Cayman) Holding has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Prinx Chengshan (Cayman) Holding, it has a TSR of 47% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Prinx Chengshan (Cayman) Holding boasts a total shareholder return of 47% for the last year (that includes the dividends) . We regret to report that the share price is down 3.4% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. If you would like to research Prinx Chengshan (Cayman) Holding in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.