This High-Flying Stock Has a $3.7 Billion Secret Weapon

Shares of Freeport-McMoRan (NYSE: FCX) have already demonstrated their potential with a 13% gain this year that has easily outpaced the S&P 500's near 5% improvement. This success story is just the beginning, and it's a strong indicator of the potential for this commodity play to outperform the market.

I am optimistic that this trend could continue, and it's not just a case built on a bullish outlook for the price of copper. Here's why.

The case for Freeport-McMoRan stock

Given its exposure to copper and, to a lesser extent, molybdenum and gold, there's no point buying the stock unless you are either optimistic about the price of copper or willing to accept the current price over the long term.

In both scenarios (bullish and agnostic), Freeport-McMoRan is an attractive stock. Investors can benefit from its "secret weapon," namely its leaching technology, which distinguishes the company from its competition.

More on that in a moment, but first, I want to outline why the stock should interest investors not interested in playing the guessing game of where copper prices are heading: the "agnostic" case.

The no-view view

On every quarterly earnings presentation, management updates investors on its earnings before interest, taxation, depreciation, and amortization (EBITDA) and operating-cash-flow sensitivity to the price of copper.

This quarter was no different, and management said its operating cash flow in 2025/2026 would be $7.5 billion at a copper price of $4 per pound, ranging to $11 billion at a price of $5 per pound.

Since the current price is around $4.57 per pound, agnostic investors might pencil in an operating cash flow of $9.3 billion for 2025/2026. Management estimates its capital spending in 2025 will be $3.9 billion. Stripping this from the operating cash flow means around $5.4 billion in free cash flow (FCF) in 2025, putting Freeport-McMoRan on a price-to-FCF multiple of 13.2 times. That's an excellent multiple.

Freeport-McMoRan's secret weapon and its growing arsenal

The case for copper is based on a combination of strong underlying demand growth driven by powerful trends such as the electrification of everything, the clean energy transition, and even investment in data centers to power artificial-intelligence applications.

There's also a supply-side story here, whereby the increasing difficulty of acquiring mining permits makes it harder to add mining capacity. There's also always the question of potential increases in royalties and export duties that miners must pay.

As such, the winning miners can expand capacity at the right time while their competitors struggle to do so. Freeport can do this through its leaching technology initiative, which aims to recover previously unrecoverable copper from its waste stockpiles.

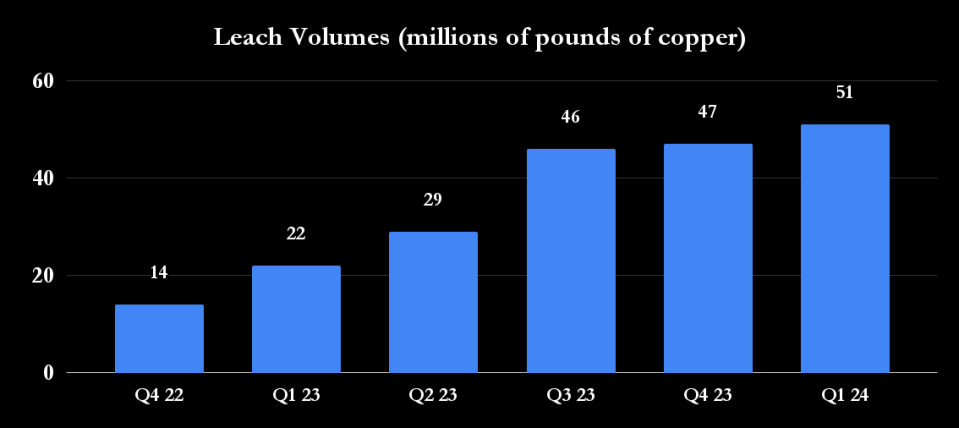

Management is making good progress on the initiative, with 51 million pounds in the first quarter of 2024, meaning it hit its initial target of a run rate of 200 million pounds.

Management plans to hit an annual rate of 300 million pounds to 400 million pounds from the initiative over the next couple of years, and ultimately 800 million pounds over time. At the current price of copper, that's equivalent to $3.66 billion in value.

As soon-to-be CEO Kathleen Quirk noted on the earnings call, "That's the equivalent of a large-scale copper mine with low capital intensity, low cost, and a low carbon footprint." It's also equivalent to around 19% of Freeport-McMoRan's planned sales of 4.15 billion pounds in 2024.

In addition to the leaching initiative, the company has projects to expand its existing mines in Arizona and Chile, which can significantly increase annual copper production. Putting all these projects together, Quirk believes it can add 400 million pounds of copper per year within two to three years without "significant investment or long lead times" and 1.7 billion pounds in seven to eight years.

A stock to buy?

Freeport-McMoRan intends to extend its operating rights in its core operations in Indonesia beyond 2041. With the leaching initiative and expansion opportunities discussed above, the stock is ideally placed to benefit from any long-term uptick in the price of copper. As such, it's an ideal stock to buy for copper bulls.

Should you invest $1,000 in Freeport-McMoRan right now?

Before you buy stock in Freeport-McMoRan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Freeport-McMoRan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This High-Flying Stock Has a $3.7 Billion Secret Weapon was originally published by The Motley Fool