Here's Why China Sandi Holdings (HKG:910) Has A Meaningful Debt Burden

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that China Sandi Holdings Limited (HKG:910) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for China Sandi Holdings

What Is China Sandi Holdings's Debt?

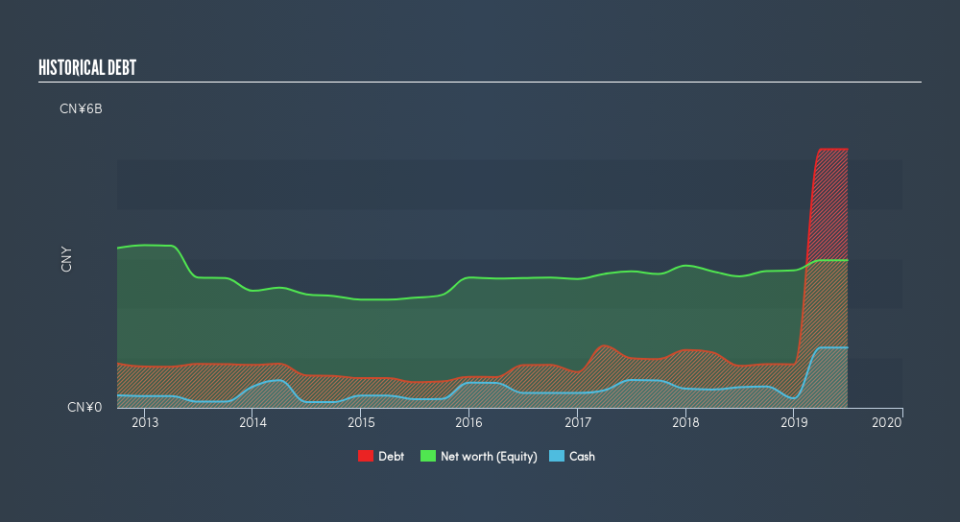

As you can see below, at the end of June 2019, China Sandi Holdings had CN¥5.20b of debt, up from CN¥842.9m a year ago. Click the image for more detail. However, because it has a cash reserve of CN¥1.21b, its net debt is less, at about CN¥3.99b.

How Healthy Is China Sandi Holdings's Balance Sheet?

We can see from the most recent balance sheet that China Sandi Holdings had liabilities of CN¥11.0b falling due within a year, and liabilities of CN¥4.31b due beyond that. Offsetting these obligations, it had cash of CN¥1.21b as well as receivables valued at CN¥2.76b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥11.4b.

The deficiency here weighs heavily on the CN¥2.74b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, China Sandi Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Strangely China Sandi Holdings has a sky high EBITDA ratio of 57.2, implying high debt, but a strong interest coverage of 16.4. So either it has access to very cheap long term debt or that interest expense is going to grow! Pleasingly, China Sandi Holdings is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 209% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since China Sandi Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, China Sandi Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

While China Sandi Holdings's level of total liabilities has us nervous. To wit both its interest cover and conversion of EBIT to free cash flow were encouraging signs. We think that China Sandi Holdings's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Over time, share prices tend to follow earnings per share, so if you're interested in China Sandi Holdings, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.