If You Had Bought Integrated Payment Technologies (ASX:IP1) Shares A Year Ago You'd Have A Total Return Of -29%

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Integrated Payment Technologies Limited (ASX:IP1) shareholders over the last year, as the share price declined 50%. That falls noticeably short of the market return of around 25%. Integrated Payment Technologies hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. In the last ninety days we've seen the share price slide 60%.

See our latest analysis for Integrated Payment Technologies

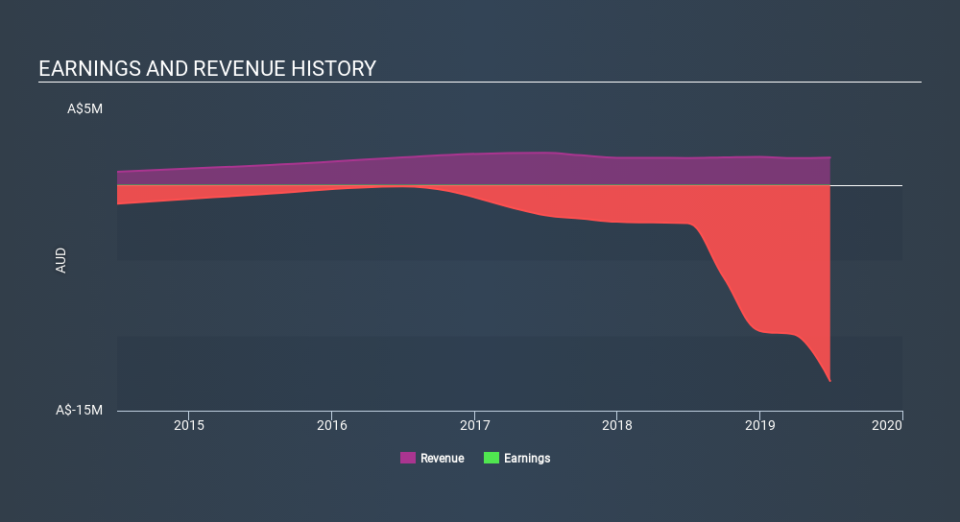

Because Integrated Payment Technologies is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Integrated Payment Technologies increased its revenue by 1.2%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 50% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Integrated Payment Technologies's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Integrated Payment Technologies hasn't been paying dividends, but its TSR of -29% exceeds its share price return of -50%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Given that the market gained 25% in the last year, Integrated Payment Technologies shareholders might be miffed that they lost 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 60% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Integrated Payment Technologies by clicking this link.

Integrated Payment Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.