If You Had Bought Crown Lifters (NSE:CROWN) Stock Three Years Ago, You'd Be Sitting On A 68% Loss, Today

Crown Lifters Limited (NSE:CROWN) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the fact that the returns over the last three years have been disappointing. Indeed, the share price is down a tragic 68% in the last three years. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

View our latest analysis for Crown Lifters

Given that Crown Lifters didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years Crown Lifters saw its revenue shrink by 7.7% per year. That is not a good result. The share price decline of 32% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

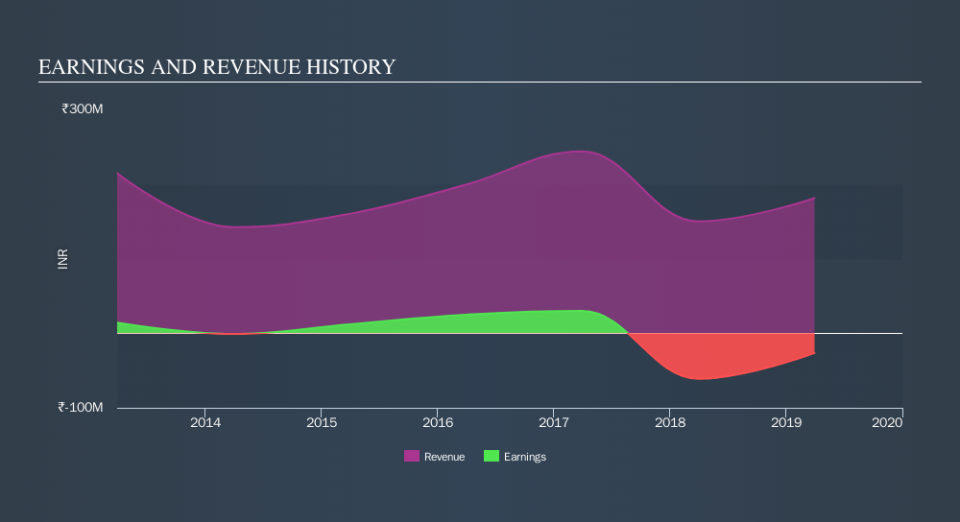

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Crown Lifters shareholders are down 37% for the year, but the broader market is up 1.2%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 31% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of Crown Lifters's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.