GoPro (GPRO) Down 6% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for GoPro, Inc. GPRO. Shares have lost about 6% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock’s next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

GoPro Posts Q1 Loss, Reports Robust Sales Growth

GoPro earnings went back to the red after just one quarter of posting positive earnings figures, as it reported first-quarter 2017 adjusted loss of $0.53 per share. Before fourth-quarter 2016, the company lost money for six straight quarters.

The action camera maker’s bottom-line figure beat the Zacks Consensus Estimate of a loss of $0.54 by one penny.It seems that the company’s substantial cost-cutting initiatives are starting to stem its earnings decline.

On a GAAP basis, the company reported a huge loss of $0.78 for the quarter, which was flat year over year.

The company posted better-than-expected revenue numbers for the quarter and also reduced its operating expenses significantly. Interestingly, the first-quarter earnings results reflect some of the first positive developments the company has seen in several quarters.

Inside the Headlines

GoPro surprised investors with its sales figures, as its quarterly revenues grew 19.1% from the prior-year quarter’s tally to $218.6 million. This marked the company’s second consecutive quarter of revenue growth after four successive quarters of sales declines. The top line also beat the Zacks Consensus Estimate of $208.3 million.

The revenue growth was driven by robust sales of the latest Hero5 cameras, the re-launch of Karma and strong accessory revenue.

HERO5 Black was the best-selling digital imaging device in units and dollars in the U.S. in the reported quarter.Nearly two-thirds of GoPro's revenue came from outside the U.S., with its HERO5 camera proving to be particularly popular in China and Europe. GoPro also indicated a "strong start" for its Karma drone. Karma was recently launched in Europe and the company plans to launch it in Asia next month.

For the quarter, R&D expenses were down almost 14.1% year over year. In addition, sales and marketing expenses declined 14.6% year over year.First-quarter operating expenses came in at $156.8 million, down 13.5% year over year.

Non-GAAP gross margins contracted 70 bps year over year to 32.3%. Non-GAAP operating loss came in at $60.3 million, as against an operating loss of $96.8 million generated last year.

The company recently launched GoPro Plus in EMEA and APAC. GoPro Plus is a cloud-based subscription service that enables auto-upload of footage from a GoPro camera to a GoPro Plus cloud account for on-the-go access, editing and sharing, using a smartphone and the Quik app. Even though it is early days, GoPro Plus is witnessing better-than-expected conversion from trial to paid versions with lower-than-expected churn.

Also, GoPro’s social channels are up over 25% year-over-year with almost 32 million followers, which indicates growing interest in the company.

Restructuring

GoPro has been aggressively cutting costs in recent timesthrough a series of layoffs and revealed plans to cut 270 jobs last month. Last year, the company conducted two rounds of layoffs, cutting 7% and 15% of its workforce in January and November, respectively. GoPro also shuttered its entertainment and media business as part of the restructuring.

GoPro also shifted most of its software development to a more economical location like Romania, and its customer support and administrative services have been moved to the Philippines. The company has streamlined its supply chain and also made changes to its product packaging and shipping.

GoPro believes that its restructuring efforts will help it bring down full-year GAAP operating expenses below $585 million and non-GAAP operating expenses below $495 million. The company also assured that it would bring down operating expenses by over $200 million and return to EBITDA profitability in 2017.

In addition, it affirmed that these cost-cutting efforts will not interfere with its pipeline of hardware and software product launches.

Notable Developments

Last week, GoPro announced the development of Fusion, a 5.2k spherical camera that is designed to be capable of capturing both virtual reality and standard video and picture.Along with the new camera, a pilot program was also launched, allowing professional content creators to gain access to the camera before the public.Fusion is scheduled to be on the market by the end of 2017 and will likely be available in the holiday season to boost sales.

GoPro also rolled out a Trade-Up Program to ramp up its camera sales earlier this month. Per the program, owners would receive $100 off a HERO5 Black or $50 off a HERO5 Session when they trade-in any previous generation GoPro camera, working or not.

Liquidity

Exiting the quarter, the company had cash and cash equivalents of $74.9 million, down significantly from $192.1 million as on Dec 31, 2016.

Guidance

In light of a comparatively strong quarter, the company gave a decent guidance for second-quarter 2017. It projects revenues of about $270 million (+/- 10 million) for the quarter. The company expects gross margin to be 33.5% (+/- 1%).

For full-year 2017, GoPro plans to limit its operating expenses in 2017 to $495 million, in an attempt to try to return to full-year profitability next year. This is comparable to a 2016 figure of about $709 million.

GoPro should be able to attain these massive cost reductions, in light of its recent job cuts and business restructuring, which did away with many high-cost operations, including its entertainment division.

It is likely that GoPro’s sales will gradually improve as it ramps production and expands Karma's reach to international markets. This will supplement its cost-reduction initiatives and enable the company to achieve sustained, profitable growth.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

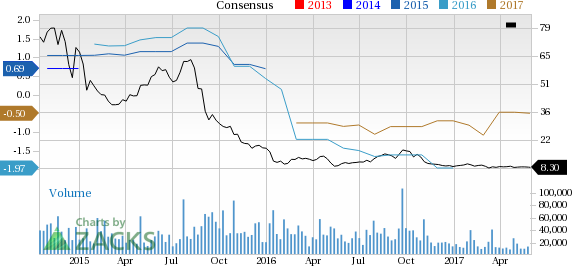

GoPro, Inc. Price and Consensus

GoPro, Inc. Price and Consensus | GoPro, Inc. Quote

VGM Scores

At this time, GoPro's stock has a nice Growth Score of 'B', a grade with the same score on the momentum front. However, the stock was allocated a grade of 'F' on the value side, putting it in the lowest quintile for this investment strategy.

Overall, stock has an aggregate VGM Score of 'D'. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our styles scores, the stock is suitable for growth and momentum investors.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Click for Free GoPro, Inc. (GPRO) Stock Analysis Report >>

To read this article on Zacks.com click here.

Zacks Investment Research