GBP/USD Fundamental Analysis – week of July 3, 2017

It is a sign of the times that on the month that the Fed hiked rates and gave the dollar a boost, many of the other major currencies have ended the last week and the month higher against the dollar. This includes the pound, which was expected to be the weakest currency of all, considering the hung Parliament that the elections had thrown up and the risks and the uncertainties that the Brexit process is expected to bring along.

GBPUSD Moves Higher On Hawkish BOE

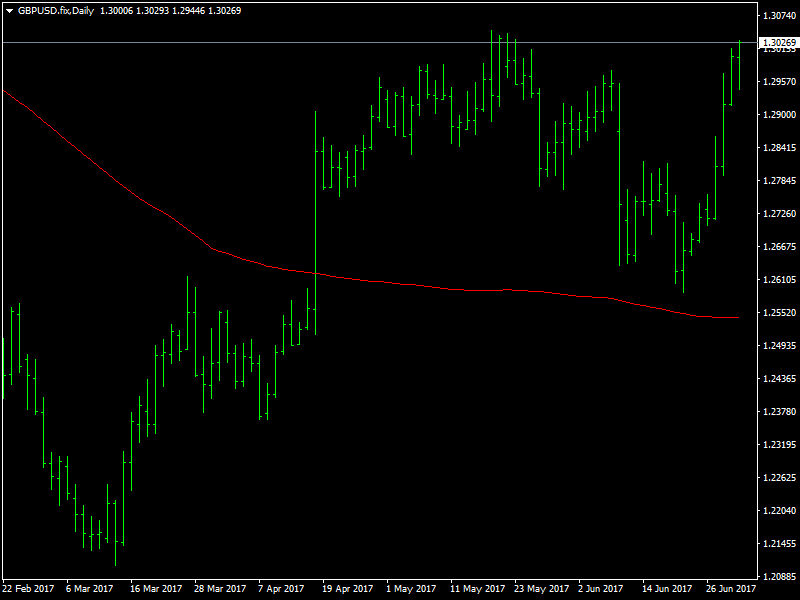

It turned out to be a very bullish week for the pound as the BOE, once again, came to the rescue of the pound just when it seemed that it was caught in a tight range and could not progress much further. The GBPUSD pair struggled to break through the 1.28 region despite the large rise in the euro backed by hawkish comments from Draghi and also the general weakness in the dollar across the board due to the delay in the healthcare reform bill. It was clear that just the weakness in the dollar was not enough to push the pound higher and it needed something fundamental in the UK to change for this to happen.

That fundamental change was indicated by the BOE Governor Carney in his speech where he indicated that they were nearing the time when they had to think seriously about tapering. After the strong hints from the BOE about rate hikes a couple of weeks back, when the BOE minutes showed 3 members voting for a hike, this hint of tapering from Carney was a definite sign that the BOE was thinking about a policy reversal and this was a huge boost to the pound. This saw the GBPUSD pair skyrocket through 1.28 and then 1.29 before settling just below the key resistance at 1.3030 to end the week.

Looking ahead to the new week, it is the first week of the month and so we have a lot of data from the US, including the FOMC minutes and the NFP. Both of these would be watched closely for hints on when the next rate hike would be. We also have the manufacturing, services and construction PMI data from the UK. The key would be the 1.3030 region and a clean break of this region would encourage the buyers immensely and help to push the GBPUSD pair towards 1.32 and further.

This article was originally posted on FX Empire