Forget the Nasdaq -- Invest in This Unstoppable ETF Instead

The Nasdaq Composite index is often considered the primary benchmark for technology and growth investors. It leans heavily into the tech sector and has even outperformed the S&P 500 over the past decade.

There's nothing wrong with following either of those major indexes, but those looking to maximize their total returns could do even better.

A seemingly unstoppable exchange-traded fund (ETF) -- the Invesco QQQ ETF (NASDAQ: QQQ) -- has steadily outperformed both indexes.

Here are three reasons why that's been the case and why the Invesco QQQ ETF's high-flying days likely aren't over.

1. It focuses on winners

The Invesco QQQ ETF tracks a subset of the Nasdaq Composite, which has a whopping 2,500 companies in it. Specifically, it tracks the Nasdaq 100, which represents the cream of the crop -- the 100 largest non-financial companies trading on the Nasdaq stock exchange. It's an exclusive club of winning companies like the big technology firms that comprise "The Magnificent Seven."

While the Nasdaq Composite contains the same stocks, the presence of thousands of other names dilutes the returns of the top companies. A concentration in those top 100 stocks is what tips the scales in the Invesco QQQ ETF's favor.

2. It's been outperforming for a long time

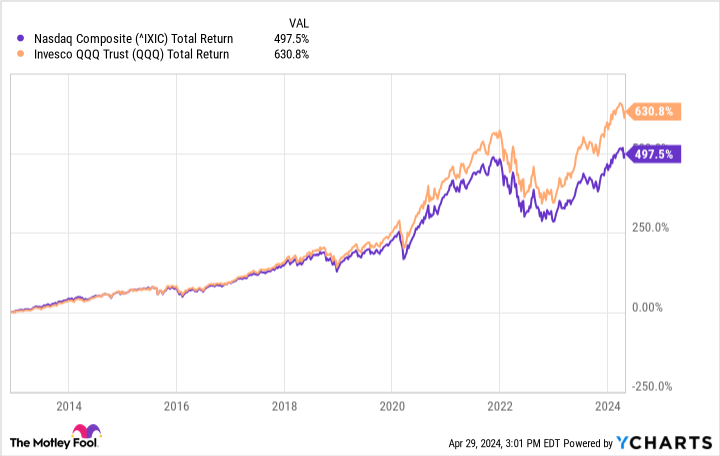

You've probably heard the disclaimer: Past results don't guarantee future outcomes. That's 100% true in investing; you should always look forward. However, the past can give investors clues about the future, especially when it's a long, consistent history. That definitely applies to the Invesco QQQ ETF, which has not only outperformed the Nasdaq Composite in recent years but going back 10 and 20 years as well.

Again, that doesn't mean this will always be the case, but it's a solid indicator the Invesco QQQ ETF has what it takes to outperform the broad market for long-term investors.

3. Big technology is here to stay

The fund's success is primarily due to big technology stocks that have ridden major secular tailwinds for years. These industry leaders include Amazon, Apple, Microsoft, Alphabet, and Nvidia, which have benefited from advancements across cloud computing, the internet, e-commerce, and artificial intelligence (AI).

These tailwinds aren't subsiding anytime soon. For example, e-commerce still accounts for just 15% of total retail sales in the U.S. Cloud computing is already a $500 billion market, but it could triple by 2030. Vehicles are inching closer to autonomy, and artificial intelligence is advancing at an incredible rate.

If you're looking for exposure to these important themes, it doesn't get much better than the Invesco QQQ ETF. The Magnificent Seven is in its top 10 holdings, making up a whopping 40% of the entire fund's portfolio. These companies are at the forefront of rapidly growing end markets, which they're able to capitalize on with massive cash flows and leading platforms to reach users.

The Invesco QQQ ETF is a more concentrated bet on the world's best technology companies. The elements that have allowed the fund to generate incredible returns over the past few decades are still present, and it's poised to extend its success over the coming years.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget the Nasdaq -- Invest in This Unstoppable ETF Instead was originally published by The Motley Fool