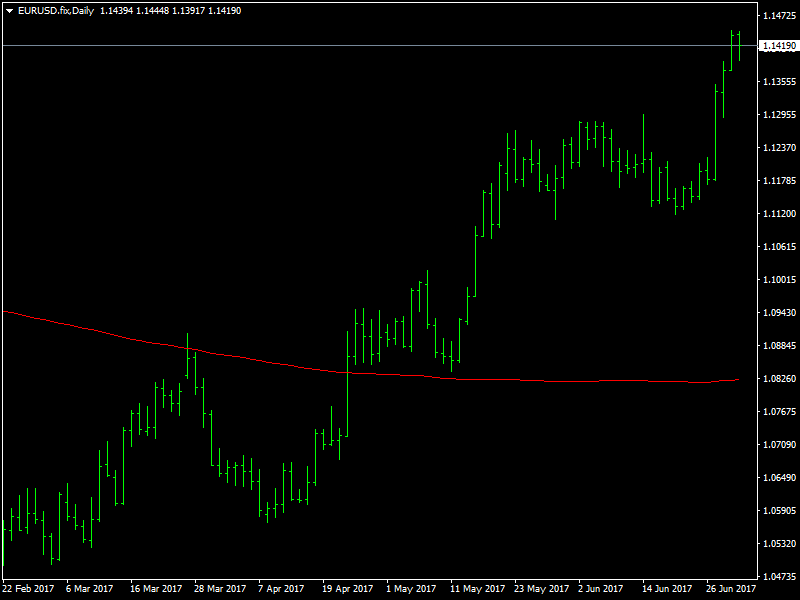

EUR/USD Fundamental Analysis – week of July 3, 2017

The EURUSD pair had a highly bullish week as the pair shot up by close to 300 pips during the course of the week. What was more important was the fact that it finally managed to break through the 1.13 region which had been an area of strong selling over the past few weeks and an area where the bulls have repeatedly failed in their efforts to break through. The pair also closed the week on a strong note just below the next region of resistance and this should augur well for the coming week.

EURUSD Rips Higher on Hawkish ECB

The strength in the pair was not only due to the weakness in the dollar that was seen across the board but also due to the strength in the euro as well. We have seen a systemic change in the currency markets over the last week or so where the currencies like the euro, the pound and the CAD have got a fillip due to the hints of policy reversal from the respective central banks as the US is midway through the same. It shows a recovery in the respective economies and that augurs well for them.

Over last week, we saw the ECB President Draghi drop his strongest hints yet of tapering the QE during his speech. Though a clarification was issued saying that Draghi’s comments should not be viewed as hawkish as the market had done, the line of thinking in the ECB was clear and it was also very well supported by the incoming data from the Eurozone. This helped the pair to push through the crucial resistance region at 1.13 and rocket higher. Also, we saw the dollar weaken across the board as the healthcare reform bill got delayed even further which raised a lot of fear and uncertainty that other such important bills, like the tax cut plan, could also get delayed indefinitely. This was negative for the dollar and it showed as the EURUSD pair shot through 1.14 and went higher till it stalled at the 1.1430 resistance region.

Looking ahead to the coming week, it is the first week of the month and we have a slew of data from the various countries, including the FOMC minutes and culminating in the NFP on Friday. The data from the US will be watched closely as the markets would want some strong data to support its belief of a rate hike in September. This seems the only hope for the dollar bulls to bring in any sort of correction in the EURUSD pair.

This article was originally posted on FX Empire