If You Like EPS Growth Then Check Out Wai Kee Holdings (HKG:610) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Wai Kee Holdings (HKG:610). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Wai Kee Holdings

How Fast Is Wai Kee Holdings Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Who among us would not applaud Wai Kee Holdings's stratospheric annual EPS growth of 42%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

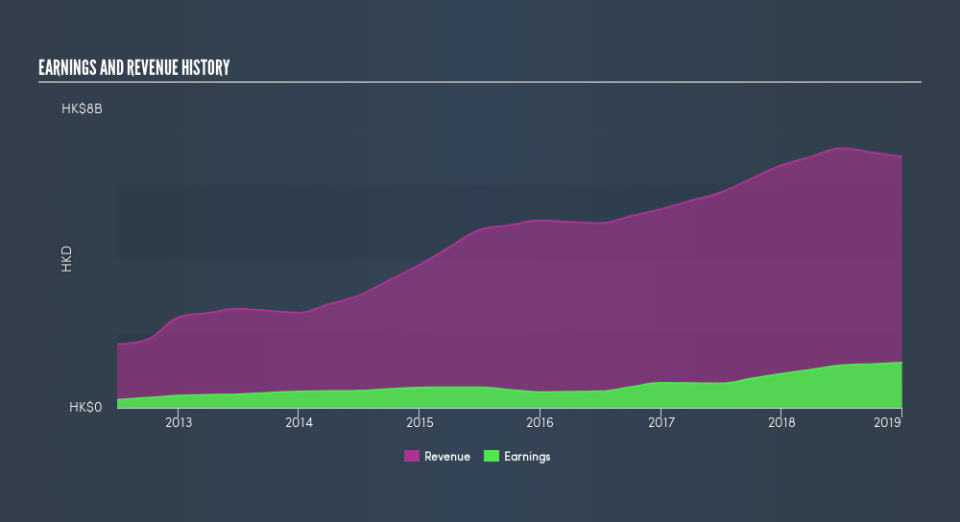

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Wai Kee Holdings is growing revenues, and EBIT margins improved by 2.3 percentage points to 5.2%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Wai Kee Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent HK$66m buying Wai Kee Holdings shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by Vice Chairman & CEO Wei Peu Zen for HK$44m worth of shares, at about HK$4.20 per share.

On top of the insider buying, we can also see that Wai Kee Holdings insiders own a large chunk of the company. In fact, they own 50% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a whopping HK$2.0b. That means they have plenty of their own capital riding on the performance of the business!

Does Wai Kee Holdings Deserve A Spot On Your Watchlist?

Wai Kee Holdings's earnings per share have taken off like a rocket aimed right at the moon. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Wai Kee Holdings on your watchlist. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Wai Kee Holdings shapes up to industry peers, when it comes to ROE.

The good news is that Wai Kee Holdings is not the only growth stock with insider buying. Here's a a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.