If EPS Growth Is Important To You, OSK Holdings Berhad (KLSE:OSK) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like OSK Holdings Berhad (KLSE:OSK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide OSK Holdings Berhad with the means to add long-term value to shareholders.

See our latest analysis for OSK Holdings Berhad

How Fast Is OSK Holdings Berhad Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In previous twelve months, OSK Holdings Berhad's EPS has risen from RM0.19 to RM0.21. That's a fair increase of 7.3%.

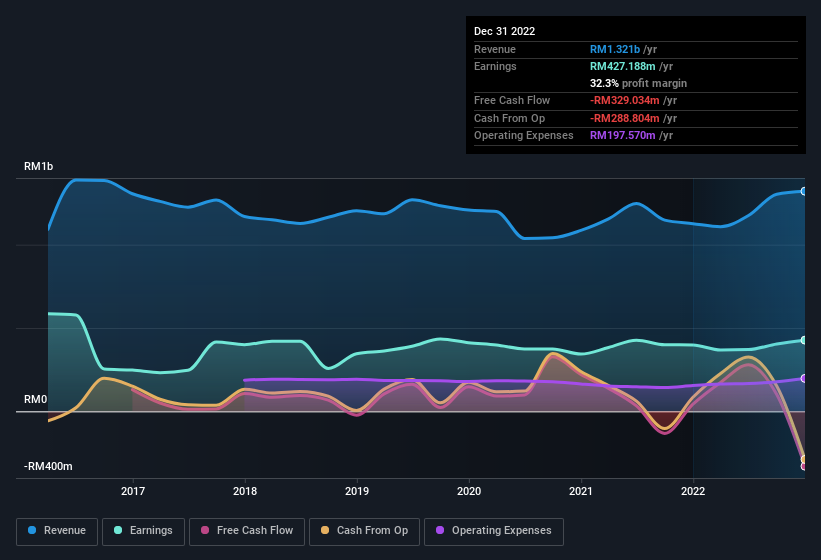

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that, last year, OSK Holdings Berhad's revenue from operations was lower than its revenue, so that could distort our analysis of its margins. OSK Holdings Berhad maintained stable EBIT margins over the last year, all while growing revenue 17% to RM1.3b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for OSK Holdings Berhad's future profits.

Are OSK Holdings Berhad Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. OSK Holdings Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Given insiders own a significant chunk of shares, currently valued at RM270m, they have plenty of motivation to push the business to succeed. That holding amounts to 13% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

Should You Add OSK Holdings Berhad To Your Watchlist?

One important encouraging feature of OSK Holdings Berhad is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. Before you take the next step you should know about the 2 warning signs for OSK Holdings Berhad (1 is significant!) that we have uncovered.

Although OSK Holdings Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here