What does Shandong Molong Petroleum Machinery Company Limited’s (HKG:568) Balance Sheet Tell Us Abouts Its Future?

While small-cap stocks, such as Shandong Molong Petroleum Machinery Company Limited (SEHK:568) with its market cap of HK$3.52B, are popular for their explosive growth, investors should also be aware of their balance sheet to judge whether the company can survive a downturn. Energy Services companies, especially ones that are currently loss-making, are inclined towards being higher risk. So, understanding the company’s financial health becomes crucial. Here are few basic financial health checks you should consider before taking the plunge. Nevertheless, I know these factors are very high-level, so I’d encourage you to dig deeper yourself into 568 here.

How does 568’s operating cash flow stack up against its debt?

568 has built up its total debt levels in the last twelve months, from CN¥1,968.5M to CN¥2,581.8M – this includes both the current and long-term debt. With this increase in debt, 568 currently has CN¥679.4M remaining in cash and short-term investments , ready to deploy into the business. Additionally, 568 has generated cash from operations of CN¥104.4M in the last twelve months, resulting in an operating cash to total debt ratio of 4.04%, signalling that 568’s current level of operating cash is not high enough to cover debt. This ratio can also be interpreted as a measure of efficiency for loss making companies as traditional metrics such as return on asset (ROA) requires positive earnings. In 568’s case, it is able to generate 0.04x cash from its debt capital.

Can 568 meet its short-term obligations with the cash in hand?

Looking at 568’s most recent CN¥3,726.8M liabilities, the company has not been able to meet these commitments with a current assets level of CN¥2,143.3M, leading to a 0.58x current account ratio. which is under the appropriate industry ratio of 3x.

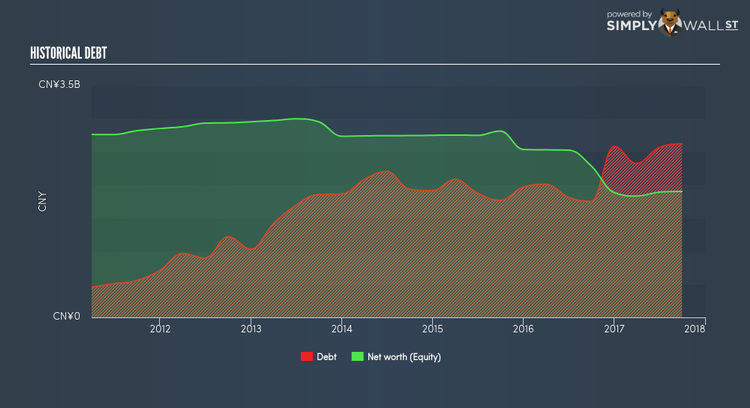

Does 568 face the risk of succumbing to its debt-load?

Since total debt levels have outpaced equities, 568 is a highly leveraged company. This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. However, since 568 is currently loss-making, there’s a question of sustainability of its current operations. Running high debt, while not yet making money, can be risky in unexpected downturns as liquidity may dry up, making it hard to operate.

Next Steps:

Are you a shareholder? 568’s high debt levels is not met with high cash flow coverage. This leaves room for improvement in terms of debt management and operational efficiency. In addition to this, the company may not be able to pay all of its upcoming liabilities from its current short-term assets. In the future, 568’s financial situation may change. You should always be researching market expectations for 568’s future growth on our free analysis platform.

Are you a potential investor? 568’s high debt levels along with low cash coverage of debt in addition to low liquidity coverage of short-term commitments may send potential investors running the other way. Though, keep in mind that this is a point-in-time analysis, and today’s performance may not be representative of 568’s track record. I encourage you to continue your research by taking a look at 568’s past performance analysis on our free platform to figure out 568’s financial health position.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.