Devon Energy's Decision to De-Emphasize the Dividend Could Pay Off

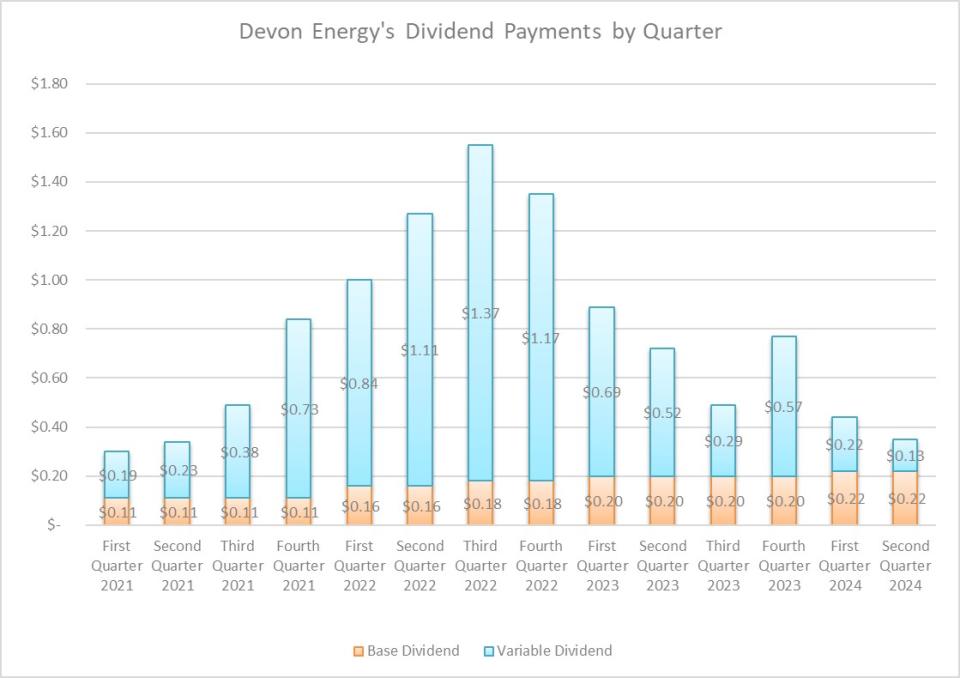

Devon Energy (NYSE: DVN) has been a monster dividend stock in recent years. A few years ago, the oil company launched the industry's first fixed-plus-variable dividend framework. It aimed to pay a fixed base dividend each quarter and up to 50% of its excess free cash flow in variable dividends. Higher oil prices in 2022 sent its free cash flow and variable dividend payments soaring.

However, the company shifted its capital return framework this year to give it more flexibility. As a result, its dividend payment was much lower in the first quarter as it emphasized repurchasing its shares. That change could pay off for shareholders in the long run.

The dividend's downward trend

Devon Energy recently reported its first-quarter results and declared its latest dividend payment. The company is paying $0.35 per share in dividends, consisting of a $0.22 per share base dividend (which it increased by 10% earlier this year) and a $0.13 per share variable dividend. That combined payout was near Devon's lowest level since it launched the new framework in 2021.

Devon Energy's most recent combined dividend payment cost the company $225 million ($143 million fixed and $82 million variable). It easily covered its dividend with cash flow. The company's operating cash flow totaled $1.7 billion in the quarter (up 4% from the year-ago period), while its free cash flow was $844 million after funding capital projects. That put Devon's total dividend outlay at about 27% of its free cash flow, well below its former target of paying at least 50% of its excess free cash flow in variable dividends (and that was after paying its fixed quarterly dividend).

The company made the strategic decision to use more of its free cash flow to prioritize share repurchases and improve its balance sheet in 2024. It repurchased $205 million in shares during the first quarter. On top of that, Devon has been increasing its cash balance (it grew by $274 million to $1.1 billion at the end of the first quarter). That positions the company to retire $1 billion in debt over the next two years as it matures.

Capitalizing on the situation

Devon Energy has shifted its capital return focus to share repurchases because the stock trades at a very compelling level compared to the broader market. It trades at a 9% free cash flow yield, assuming oil averages $80 a barrel this year (around the recent level). That's three times higher than the Nasdaq (3% free cash flow yield) and more than double the S&P 500 (4%), implying it's significantly cheaper than those broad market indexes.

That's not unique to Devon Energy. Energy companies currently contribute about 10% of the S&P 500's earnings. However, the sector only makes up about 4% of that broad market index. That's well below the historical average of a little more than 10%.

Given its discounted valuation, Devon can repurchase a meaningful number of its outstanding shares. The $205 million spent on share repurchases in the first quarter retired 4.7 million shares. That brought the total to 49.5 million ($2.5 billion) since it started the program in late 2021. That has retired more than 5% of its outstanding shares.

The company has $500 million remaining on its current $3 billion authorization. That's enough to retire an additional 1.6% of its outstanding shares at its recent market cap. Given its preference for share repurchases, Devon will likely increase its capacity as it gets closer to exhausting the current authorization.

Continued share repurchases will drive higher earnings and production growth rates on a per-share basis. They will also enable the company to continue increasing its base dividend at an attractive rate, since it will make future payments across fewer shares. This faster growth should eventually help boost Devon's valuation.

The move makes sense

Devon Energy shifted its capital return strategy this year, giving it more flexibility to prioritize share repurchases. This allows it to take greater advantage of its low valuation, which should help boost its per-share growth rate in the future. The buybacks could eventually help lift its valuation, potentially driving stronger total returns for shareholders in the coming years.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 30, 2024

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Devon Energy's Decision to De-Emphasize the Dividend Could Pay Off was originally published by The Motley Fool